UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No.)

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ Preliminary Proxy Statement |

¨ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

| x Definitive Proxy Statement | |

| ¨ Definitive Additional Materials | |

| ¨ Soliciting Material Pursuant to Rule §240.14a-12 |

SALEM MEDIA GROUP, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| 1. | Title of each class of securities to which transaction applies: | |

| 2. | Aggregate number of securities to which transaction applies: | |

| 3. | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

| 4. | Proposed maximum aggregate value of transaction: | |

| 5. | Total fee paid: | |

SEC 1913 (04-05)

Persons who are to respond to the collection of information

contained in this form are not required to respond unless the

form displays a currently valid OMB control number.

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| 1. | Amount Previously Paid: | |

| 2. | Form, Schedule or Registration Statement No.: | |

| 3. | Filing Party: | |

| 4. | Date Filed: | |

4880 Santa Rosa Road

Camarillo, CA 93012

(805) 987-0400

April 8, 2016

Dear Stockholder:

You are cordially invited to attend the 2016 Annual Meeting of Stockholders (the “Annual Meeting”) of Salem Media Group, Inc. (“Salem”). The Annual Meeting is scheduled to be held on Wednesday, May 18, 2016, at Salem’s corporate offices, which are located at 4880 Santa Rosa Road, Camarillo, California, at 9:30 a.m. P.D.T. As described in the accompanying Notice of Annual Meeting of Stockholders and Proxy Statement, the agenda for the Annual Meeting includes:

| 1. | The election of the nine (9) persons named in the accompanying Proxy Statement to the Board of Directors to serve until the next Annual Meeting of Stockholders or until their respective successors are duly elected and qualified. |

| 2. | An advisory (non-binding) vote on a resolution approving executive compensation as disclosed pursuant to Item 402 of Regulation S-K. |

| 3. | To transact such other business as may properly come before the Annual Meeting or any adjournments or postponements thereof. |

The Board of Directors recommends that you vote FOR the election of the slate of Director nominees and FOR the approval of the advisory (non-binding) resolution approving executive compensation. Please refer to the Proxy Statement for detailed information on the above proposals. Directors and executive officers of Salem will be present at the Annual Meeting to respond to questions that our stockholders may have regarding the business to be transacted.

As we have done in prior years, we are using the U.S. Securities and Exchange Commission rule that permits companies to furnish their proxy materials over the Internet. Unless you have opted out of receiving Notices, instead of mailing you a paper copy of the proxy materials, we will be mailing to you a Notice containing instructions on how to access our proxy materials over the Internet. Therefore, a proxy card was not sent to you and you may vote only via telephone or online if you do not attend the Annual Meeting.

We urge you to vote your proxy as soon as possible. Your vote is very important, regardless of the number of shares you own. Whether or not you plan to attend the Annual Meeting in person, we urge you to vote your shares online, by telephone or, if you have chosen to receive paper copies of the proxy materials by mail, by signing, dating and returning the enclosed proxy card promptly in the accompanying postage prepaid envelope. You may, of course, attend the Annual Meeting and vote in person even if you have previously returned your proxy card. The approximate date on which this Proxy Statement and the enclosed proxy card and Notice are first being sent or made available to stockholders is April 8, 2016. On behalf of the Board of Directors and all of the employees of Salem, we wish to thank you for your support.

| Sincerely yours, |

|

|

STUART W. EPPERSON Chairman of the Board |

|

|

EDWARD G. ATSINGER III Chief Executive Officer |

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders to Be Held on May 18, 2016: Our Proxy Statement for the 2016 Annual Meeting of Stockholders and Annual Report on Form 10-K for the year ended December 31, 2015 are available at www.proxyvote.com.

If you have any questions concerning the Proxy Statement or the accompanying proxy card, or if you need any help in voting your shares, please telephone Christopher J. Henderson of Salem at (805) 987-0400.

PLEASE VOTE YOUR SHARES

ONLINE, BY TELEPHONE OR BY

SIGNING, DATING AND RETURNING

THE ENCLOSED PROXY CARD TODAY.

4880 Santa Rosa Road

Camarillo, CA 93012

(805) 987-0400

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held on May 18, 2016

NOTICE IS HEREBY GIVEN that the 2016 Annual Meeting of Stockholders (the “Annual Meeting”) of Salem Media Group, Inc. (“Salem”) will be held on Wednesday, May 18, 2016 at 9:30 a.m. P.D.T. at Salem’s corporate offices located at 4880 Santa Rosa Road, Camarillo, California, subject to adjournment or postponement by the Board of Directors, for the following purposes:

| 1. | The election of the nine (9) persons named in the accompanying Proxy Statement to the Board of Directors to serve until the next Annual Meeting of Stockholders or until their respective successors are duly elected and qualified. |

| 2. | An advisory (non-binding) vote on a resolution approving executive compensation as disclosed pursuant to Item 402 of Regulation S-K. |

| 3. | To transact such other business as may properly come before the Annual Meeting or any adjournments or postponements thereof. |

Only holders of record of Salem’s Class A common stock, par value $0.01 per share, and Class B common stock, par value $0.01 per share, on March 23, 2016, the record date, are entitled to notice of, and to vote at, the Annual Meeting and any adjournments or postponements thereof. A list of such stockholders will be available for examination by any stockholder at the time and place of the Annual Meeting.

Holders of a majority of the voting power of the outstanding shares of the Class A common stock and of the Class B common stock must be present in person or represented by proxy in order for the Annual Meeting to be held. Therefore, we urge you to review the accompanying proxy card and either vote by (a) Internet or by telephone as instructed in this Proxy Statement, or (b) if you have opted out of receiving Notices, by signing, dating and returning your completed proxy in the enclosed postage prepaid envelope whether or not you expect to attend the Annual Meeting in person. If you received only the Notice of how to access the Proxy Statement via the Internet, a proxy card was not sent to you, and you may vote only via the Internet if you do not attend the Annual Meeting or request that a proxy card be mailed to you. If you attend the Annual Meeting and wish to vote your shares personally, you may do so by validly revoking your proxy as described below.

Prior to the voting thereof, a proxy may be revoked by the person executing such proxy by: (i) filing with the Secretary of Salem either a duly executed written notice dated subsequent to such proxy revoking the same or a duly executed proxy bearing a later date, or (ii) attending the Annual Meeting and voting in person.

| By order of the Board of Directors, | ||

|

||

| CHRISTOPHER J. HENDERSON | ||

| Secretary |

Camarillo, California

April 8, 2016

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders to

Be Held on May 18, 2016: Our Proxy Statement for the 2016 Annual Meeting of Stockholders and Annual

Report on Form 10-K for the year ended December 31, 2015, are available at

www.proxyvote.com

YOUR VOTE IS IMPORTANT.

TO VOTE YOUR SHARES, PLEASE VOTE

ONLINE, BY TELEPHONE OR BY

SIGNING AND DATING THE ENCLOSED PROXY CARD

AND MAILING IT PROMPTLY

IN THE ENCLOSED RETURN ENVELOPE.

SALEM MEDIA GROUP, INC.

4880 Santa Rosa Road

Camarillo, CA 93012

(805) 987-0400

PROXY STATEMENT

ANNUAL MEETING OF STOCKHOLDERS

To Be Held on May 18, 2016

TABLE OF CONTENTS

| Page No. | |

| STOCKHOLDERS’ PROPOSALS FOR 2017 PROXY STATEMENT | 39 |

| OTHER MATTERS | 39 |

| SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE | 39 |

| ANNUAL REPORT ON FORM 10-K | 40 |

This proxy statement (“Proxy Statement”) is furnished in connection with the solicitation by the Board of Directors (the “Board” or the “Board of Directors”) of Salem Media Group, Inc., a Delaware corporation (“Salem” or the “Company”), of proxies for use at the 2016 Annual Meeting of Stockholders of the Company (the “Annual Meeting”) scheduled to be held at the time and place and for the purposes set forth in the accompanying Notice of Annual Meeting of Stockholders.

INFORMATION REGARDING VOTING AT THE ANNUAL MEETING

At the Annual Meeting, the stockholders of the Company are being asked to consider and to vote upon the following proposals:

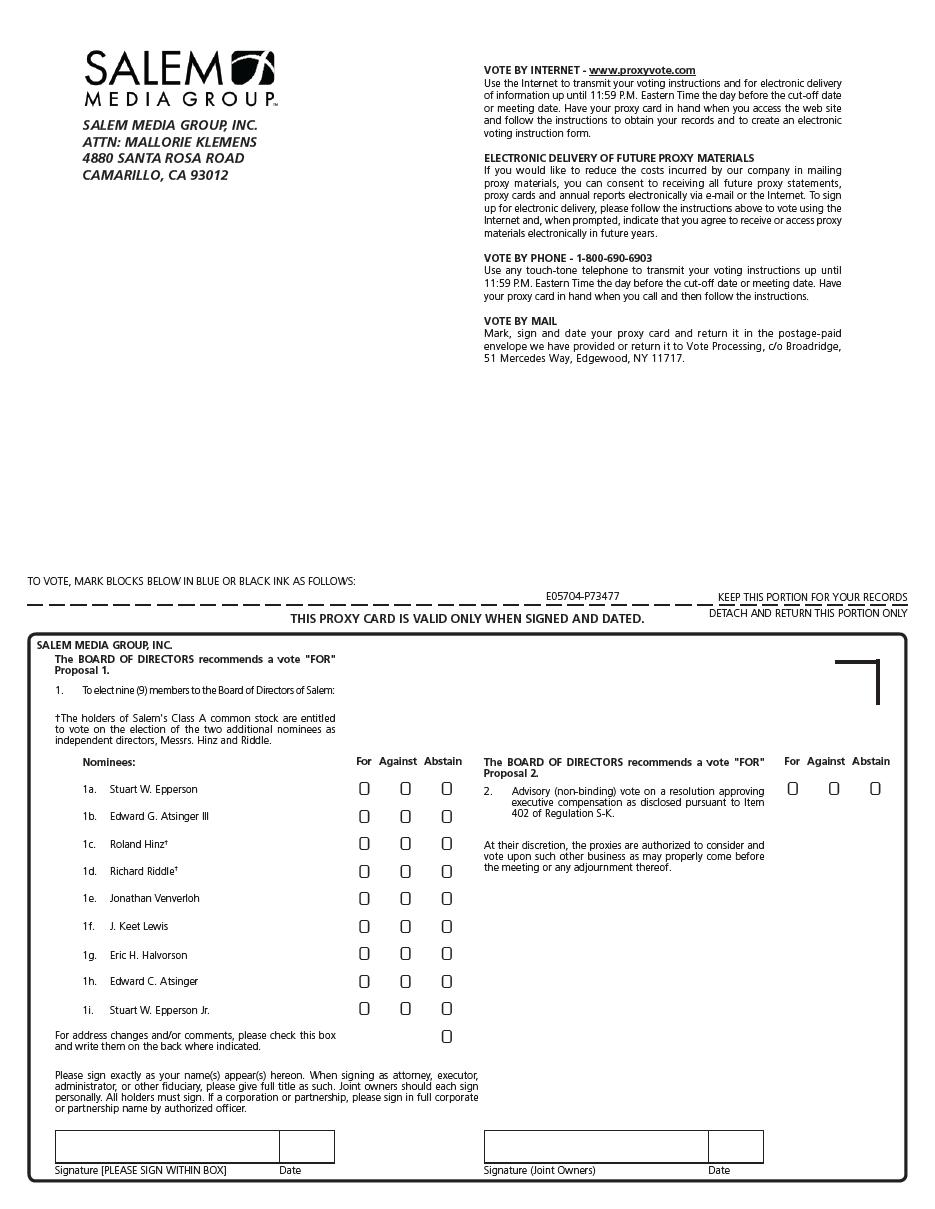

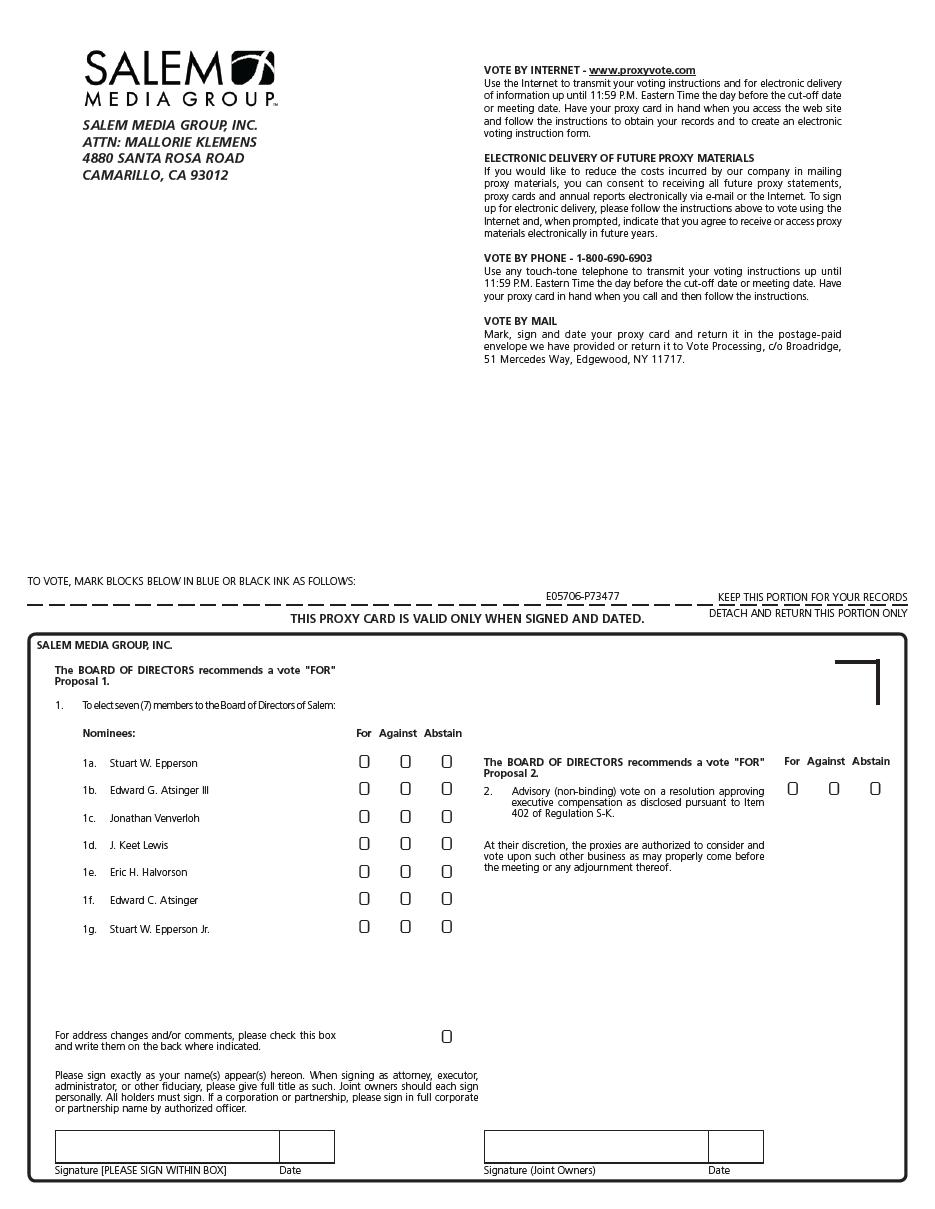

| Proposal 1 | The election of the nine (9) Directors named in this Proxy Statement to serve until the annual meeting of stockholders to be held in 2017 or until their respective successors are duly elected and qualified. |

For information regarding this proposal, see the section of this Proxy Statement entitled “PROPOSAL 1—ELECTION OF DIRECTORS.”

| Proposal 2 | An advisory (non-binding) vote on a resolution approving executive compensation as disclosed pursuant to Item 402 of Regulation S-K. |

For information regarding this proposal, see the section of this Proxy Statement entitled “PROPOSAL 2—ADVISORY (NON-BINDING) VOTE ON A RESOLUTION APPROVING EXECUTIVE COMPENSATION AS DISCLOSED PURSUANT TO ITEM 402 OF REGULATION S-K.”

Shares represented by properly executed proxies received by the Company will be voted at the Annual Meeting in the manner specified therein or, if no instructions are marked on the enclosed proxy card, in accordance with the recommendation of the Board of Directors on all matters presented in this Proxy Statement. Although management does not know of any matter other than the proposal described above to be acted upon at the Annual Meeting, unless contrary instructions are given, shares represented by valid proxies will be voted by the persons named on the accompanying proxy card in accordance with their respective best judgment in respect of any other matters that may properly be presented for a vote at the Annual Meeting.

Execution of a proxy will not in any way affect a stockholder’s right to attend the Annual Meeting and vote in person, and any person giving a proxy has the right to revoke it at any time before it is exercised by: (a) filing with the Secretary of Salem either a duly executed written notice dated subsequent to such proxy revoking the same or a duly executed proxy bearing a later date, or (b) attending the Annual Meeting and voting in person.

The mailing address of the principal executive offices of the Company is 4880 Santa Rosa Road, Camarillo, California 93012, and its telephone number is (805) 987-0400.

Record Date, Quorum and Voting

Only stockholders of record on March 23, 2016 (the “Record Date”) will be entitled to notice of and to vote at the Annual Meeting. There were outstanding on the Record Date 19,931,959 shares of Class A common stock, par value $0.01 per share (“Class A common stock”), and 5,553,696 shares of Class B common stock, par value $0.01 per share (“Class B common stock”) (the Class A common stock and the Class B common stock are collectively referred to as the “common stock”). Each share of outstanding Class A common stock is entitled to one (1) vote on each matter to be voted on at the Annual Meeting and each share of outstanding Class B common stock is entitled to ten (10) votes on each matter to be voted on at the Annual Meeting, except that, as provided in the Company’s Amended and Restated Certificate of Incorporation, the holders of Class A common stock shall be entitled to vote as a class, exclusive of the holders of the Class B common stock, to elect two (2) “Independent Directors.” The two (2) Independent Directors shall be elected by a majority of the votes of the shares of Class A common stock present in person or represented by proxy and entitled to vote on the election of the Independent Directors; the remaining seven (7) Directors will be elected by a majority of the votes of the shares of Class A common stock and Class B common stock present in person or represented by proxy and entitled to vote on the election of such Directors. For information regarding the election of Directors, see the section of this Proxy Statement entitled “PROPOSAL 1—ELECTION OF DIRECTORS.”

1

The presence in person or representation by proxy of the holders of at least a majority of the voting power of the common stock issued and outstanding and entitled to vote is necessary to constitute a quorum at the Annual Meeting. In the event there are not sufficient shares for a quorum at the time of the Annual Meeting, the Annual Meeting may be adjourned in order to permit the further solicitation of proxies.

Only votes cast in person at the Annual Meeting or received by proxy before the beginning of the Annual Meeting will be counted. Giving us your proxy means you authorize the proxy holders to vote your shares at the Annual Meeting in the manner you direct. If your shares are held in your name, you can vote by proxy in three (3) convenient ways as follows:

| • On-Line Voting: | Go to http://www.proxyvote.com and follow the instructions |

| • By Telephone: | Call toll-free 1-800-690-6903 and follow the instructions |

| • By Mail: | Complete, sign, date and return your proxy card in the enclosed envelope |

Telephone and Internet voting facilities for stockholders of record will be available 24 hours a day and will close at 11:59 p.m. on May 17, 2016.

Under Delaware law and the Company’s Amended and Restated Certificate of Incorporation and Bylaws, abstentions and broker non-votes are counted for the purpose of determining the presence or absence of a quorum for the transaction of business. With regard to Proposal 1, votes may be cast in favor of or against any particular Director nominee. With regard to Proposal 2, votes may be cast in favor of, against or abstaining with respect to the advisory (non-binding) resolution approving the executive compensation of the Company’s named executive officers as disclosed pursuant to Item 402 of Regulation S-K. Proposals 1, 2 and any other stockholder proposals that properly come before the Annual Meeting require, in general, the affirmative vote of a majority of the voting power of the shares of Class A common stock and Class B common stock present in person or represented by proxy at the Annual Meeting and entitled to vote on the subject matter. For Proposals 1 and 2, abstentions will be counted in tabulations of the votes cast on a proposal and will have the same effect as a vote against the proposal. For each proposal, broker non-votes will not be counted for purposes of determining whether the proposal has been approved. If you hold shares of our common stock through a broker, bank or other nominee, then you hold shares in street name. Thus, you must instruct the broker, bank or other nominee as to how to vote your shares. Under the rules of the New York Stock Exchange (“NYSE”), if you do not provide such instructions, the firm that holds your shares will have discretionary authority to vote your shares with respect to “routine” matters. Pursuant to NYSE rules, Proposals 1 and 2 are not considered “routine” matters; thus, your broker will not have discretionary authority to vote your shares in connection with Proposal 1 or Proposal 2 if you do not provide it with instructions.

Electronic Access to Proxy Materials

Pursuant to applicable United States Securities and Exchange Commission (“SEC”) rules, the Company is making this Proxy Statement and its Annual Report on Form 10-K available to its stockholders electronically via the Internet at www.proxyvote.com. On or about April 8, 2016, we will mail to stockholders a Notice containing instructions on how to access this Proxy Statement along with our Annual Report on Form 10-K as well as instructions on how to vote online. The Notice also instructs you on how you may submit your proxy vote securely over the Internet or by telephone. If you received a Notice, you will not automatically receive a printed copy of the Proxy Statement and Annual Report. If you would like to receive a printed copy of our proxy materials, you should follow the instructions for requesting such materials as set forth in the Notice.

The cost of preparing, assembling and sending the Notice of Annual Meeting of Stockholders, this Proxy Statement and the enclosed proxy card will be paid by the Company. Following the delivery of this Proxy Statement, Directors, Officers and other employees of the Company may solicit proxies by mail, telephone, facsimile or other electronic means, or by personal interview. Such persons will receive no additional compensation for such services. Brokerage houses and other nominees, fiduciaries and custodians nominally holding shares of Class A common stock of record will be requested to forward proxy soliciting material to the beneficial owners of such shares and will be reimbursed by the Company for their reasonable charges and expenses in connection therewith.

2

With regard to the delivery of Annual Reports and Proxy Statements, under certain circumstances the SEC permits a single set of such documents or, where applicable, one Notice, to be sent to any household at which two or more stockholders reside if they appear to be members of the same family. Each stockholder, however, still receives a separate proxy card. This procedure, known as “householding,” reduces the amount of duplicate information received at a household and reduces delivery and printing costs as well. A number of banks, brokers and other firms have instituted householding and have previously sent a notice to that effect to certain of the Company’s stockholders whose shares are registered in the name of such bank, broker or other firm. As a result, unless the stockholders receiving such notice gave contrary instructions, only one Annual Report and/or Proxy Statement, as applicable, will be delivered to an address at which two (2) or more stockholders reside. If any stockholder residing at such an address wishes to receive a separate Annual Report or Proxy Statement for the Annual Meeting or for future stockholder meetings, such stockholder should telephone toll-free 1-800-579-1639, or write to Salem Media Group, Inc., c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717. A separate set of proxy materials relating to the Annual Meeting will be sent promptly following receipt of your request. In addition, if any stockholder who previously consented to householding desires to receive a separate copy of a Proxy Statement or Annual Report, as applicable, for each stockholder at his or her same address, such stockholder should contact his or her bank, broker or other firm in whose name the shares are registered or contact the Company at the address or telephone number listed on page 1 of this Proxy Statement. Similarly, a stockholder may use any of these methods if such stockholder is receiving multiple copies of a Proxy Statement or Annual Report and would prefer to receive a single copy in the future.

3

THE BOARD OF DIRECTORS AND EXECUTIVE OFFICERS

The Board of Directors presently consists of seven (7) members and may be increased to nine (9) members in connection with the Annual Meeting (each, a “Director” or “Director Nominee”, as applicable). Director Nominees Edward C. Atsinger and Stuart W. Epperson Jr. will each be standing for election at the Annual Meeting. The following table sets forth certain information as of March 23, 2016, except where otherwise indicated, with respect to the Directors of the Company. Each of the Directors of the Company serves a one (1) year term and all Directors are subject to re-election at each annual meeting of stockholders.

| Name of Director | Age | First Became Company Director |

Position(s) Held with the Company | |||

| Stuart W. Epperson | 79 | 1986 | Chairman of the Board | |||

| Edward G. Atsinger III | 76 | 1986 | Chief Executive Officer and Director | |||

| Roland S. Hinz | 76 | 1997 | Director | |||

| Richard A. Riddle | 71 | 1997 | Director | |||

| Jonathan Venverloh | 44 | 2011 | Director | |||

| James Keet Lewis | 62 | 2014 | Director | |||

| Eric H. Halvorson | 66 | 2015 | Director | |||

| Edward C. Atsinger | 41 | N/A | Director Nominee | |||

| Stuart W. Epperson Jr. | 45 | N/A | Director Nominee |

As a national media presence with integrated operations including radio broadcasting, digital media, and publishing emphasizing Christian values, conservative family themes and news, our business involves an operational structure that operates on a broad scale and encompasses research, technical developments, and marketing functions in a context characterized by rapidly evolving technologies, exposure to business cycles, and significant competition. The Company’s Nominating and Corporate Governance Committee is responsible for reviewing and assessing with the Board the appropriate skills, experience, and background sought of Board members in the context of our business and the then-current membership on the Board. This assessment of Board skills, experience, and background includes numerous diverse factors, such as understanding of and experience in radio and new media, understanding of our audience and the ministries that serve it, and finance, marketing and advertising experience. The priorities and emphasis of the Nominating and Corporate Governance Committee and of the Board with regard to these factors may change from time to time to take into account changes in the Company’s business and other trends, as well as the portfolio of skills and experience of current and prospective Board members. The Nominating and Corporate Governance Committee and the Board will review and assess the continued relevance of and emphasis on these factors as part of the Board’s annual self-assessment process and in connection with candidate searches to determine if they are effective in helping to satisfy the Board’s goal of creating and sustaining a Board that can appropriately support and oversee the Company’s activities.

We believe that it is important for our Board members to have diverse backgrounds, skills and experiences and seek such diversity in nominating Director candidates. One goal of this diversity of backgrounds, skills and experience is to assist the Board in its oversight concerning our business and operations. We consider the key skills, qualifications and experience listed below as important for our Directors to collectively have in light of our current business and structure. The Directors’ biographies provided later in this Proxy Statement note each Director’s relevant skills, qualifications and experience. As part of an annual effectiveness review, the Board evaluates its composition to ensure that the Board as a whole sufficiently represents a diverse set of relevant backgrounds, skills and experience.

| • | Senior Executive Leadership Experience. Directors who have served in senior executive leadership positions are important to us, as they bring experience and perspective in analyzing, shaping, and overseeing the execution of important operational and policy issues at a senior level. The insights and guidance of these Directors, particularly those Directors who have experience at businesses or organizations that operated on a global scale, faced significant competition, and/or involved technology or other rapidly evolving business models enhance our Board’s ability to assess and respond to situations faced by the Company. |

4

| • | Public Company Board Experience. Directors who have served on other public company boards can offer insights with regard to the dynamics and operation of a board of directors, corporate governance matters (including experience with respect to the relationship of a Board to the CEO and other management personnel), the importance of particular public company agenda and management matters and oversight of a changing mix of strategic, operational, and compliance-related matters. |

| • | Business Development Experience. Directors who have a background in business development can provide insight into developing and implementing strategies for growing our business through acquisitions. |

| • | Financial Experience. Knowledge of accounting and financial reporting processes, as well as the financial markets, financing and funding operations, is important because it assists our Directors in understanding and overseeing the Company’s financial reporting, internal controls, capital structure, financing and investing activities. |

| • | Relevant Experience with our Audiences and Programmers. Directors who have relevant experience with the Christian and family-themed audience and the conservative news talk audience can provide insight and expertise in assisting the Board’s implementation of Company strategies for growing our business by providing an engaging experience with our radio stations, Internet sites and other services. Directors with experience and knowledge of the business of our programmers and content providers can also assist the Board with analyzing, reviewing and approving mutually beneficial and significant relationships between these content providers and the Company. |

| • | Legal Expertise. Directors who have legal education and experience can assist the Board in fulfilling its responsibilities related to the oversight of the Company’s legal and regulatory compliance and engagement with regulatory authorities. |

| • | Radio Experience. Knowledge of the radio industry and the challenges and opportunities of radio broadcasting companies is vitally important because it enables our Directors to understand and oversee many aspects of the Company’s operations, goals and strategies. |

| • | New Media Experience. As the radio industry is faced with challenges and opportunities created by the emergence of “new media”, the Board benefits from including Directors who have relevant experience with these new and emerging means of distributing programming and enhancing our audience’s ability to access information provided by the Company via different media outlets. |

Set forth below is certain information concerning the principal occupation and business experience of each of the Directors during the past five (5) years and other relevant experience.

Stuart W. Epperson

Mr. Epperson has been Chairman of the Board of the Company since its inception. He is also a Director of Salem Communications Holding Corporation, a wholly-owned subsidiary of the Company. Mr. Epperson has been engaged in the ownership and operation of radio stations since 1961 and currently serves as a Director and President of Roanoke-Vinton Radio Incorporated; as President of Sonsinger Management, Inc.; and as a Partner of Sonsinger Properties, Sonsinger Broadcasting Company of Houston, L.P. and Salem Broadcasting Company. Mr. Epperson has been a member of the Board of Directors of the National Religious Broadcasters for a number of years and was re-elected to a three (3) year term on that Board in February 2013. Mr. Epperson is married to Nancy A. Epperson, who is Mr. Atsinger’s sister. Additionally, Mr. Epperson is the father of Director Nominee Stuart W. Epperson Jr. and uncle of Director Nominee Edward C. Atsinger.

As co-founder of the Company, Mr. Epperson provides the Board with extensive and valuable radio and senior executive leadership experience, business development experience and insight into the background and vision of the Company. His past political experience as well as his continuing operation of radio stations for related businesses provide the Board with valuable relevant experience with the needs and goals of our audience and our programmers and enable Mr. Epperson to contribute to the Board by assessing the many and varied strategic opportunities presented to the Company.

5

Edward G. Atsinger III

Mr. Atsinger has been Chief Executive Officer, a Director of the Company and a Director of each of the Company’s subsidiaries since their inception. He was President of Salem from its inception through June 2007. He has been engaged in the ownership and operation of radio stations since 1969 and currently serves as a Partner of Salem Broadcasting Company, Sonsinger Properties, Sonsinger Broadcasting Company of Houston, L.P.; as a member of Atsinger Aviation, LLC, Sun Air Jets, LLC, Allyson Aviation, LLC, Greenbelt Property Management; and as President of Sonsinger Management, Inc. Mr. Atsinger has been a member of the Board of Directors of the National Religious Broadcasters for a number of years and was re-elected to a three (3) year term on that Board in February 2013. He was also a member of the National Association of Broadcasters Radio Board from 2008 through 2014. Mr. Atsinger has been a member of the Board of Directors of Oaks Christian School in Westlake Village, California since 1999. Mr. Atsinger is the brother-in-law of Mr. Epperson. Additionally, Mr. Atsinger is the father of Director Nominee Edward C. Atsinger and uncle of Director Nominee Stuart W. Epperson Jr.

As co-founder of the Company, Mr. Atsinger provides the Board with extensive and valuable radio and senior executive leadership experience, business development experience and insight into the background and vision of the Company. His longstanding association with and service on many broadcasting-related Boards of Directors over the years also provides valuable radio and new media experience as well as an understanding of the broader needs and challenges facing our industry.

Roland S. Hinz

Mr. Hinz has been a Director of the Company since September 1997. Mr. Hinz has been the owner, President and Editor-in-Chief of Hi-Torque Publishing Company, a publisher of magazines covering the motorcycling and biking industries, since 1982. Mr. Hinz is also the managing member of Hi-Favor Broadcasting, LLC, the licensee of radio stations KLTX-AM, Long Beach, California, and KEZY-AM, San Bernardino, California (which were acquired from the Company in August 2000 and December 2001, respectively), and radio station KSDO-AM, San Diego, California. Mr. Hinz also serves on the Board of Directors of the Association for Community Education, Inc., a not-for-profit corporation operating Spanish Christian radio stations in California. Mr. Hinz also served on the Board of Directors of Truth for Life, a non-profit organization that is a customer of the Company, from 2000 through September 2010.

Mr. Hinz’s qualifications to serve on the Board include his extensive business experience, skills and acumen reflected in his senior executive management experience as President and Editor-in-Chief of a magazine publishing company. He also has served as a Board member for several not-for-profit organizations, enabling him to bring valuable cross-Board experience as well as relevant experience with our audience and programmers.

Richard A. Riddle

Mr. Riddle has been a Director of the Company since September 1997. Mr. Riddle is an independent businessman specializing in providing financial assistance and consulting to individuals and manufacturing companies. He was President and majority stockholder of I.L. Walker Company from 1988 to 1997 when that company was sold. He also was Chief Operating Officer and a major stockholder of Richter Manufacturing Corp. from 1970 to 1987. In October 2010, Mr. Riddle joined the Board of Directors of Truth for Life, a non-profit organization that is a customer of the Company. Additionally, in 2010, Mr. Riddle joined the Board of Directors of Know the Truth, a non-profit organization that is also a customer of the Company.

Having an extensive career in financial matters, Mr. Riddle brings to the Board significant financial experience enabling him to assess and provide oversight concerning business and financial matters addressed by the Company.

Jonathan Venverloh

Mr. Venverloh has been a Director of the Company since September 2011. Mr. Venverloh has worked in digital media and advertising since 1994, including more than thirteen (13) years at Google and stints at a major news website and global advertising agencies. Mr. Venverloh currently serves as Director, Global Sales within Google Shopping, and from 2000-2010 he served as Google’s Head of Distribution Partnerships and launched Google’s Enterprise Division. From 1997 to 1999, Mr. Venverloh led Weather.com’s sales efforts for the West Coast. From 1994 to 1996 he worked at global ad agencies Saatchi & Saatchi and DDB Needham. Mr. Venverloh has also served as an advisor to digital media startups and served on the Boards of Directors of several non-profits. Mr. Venverloh currently serves on the Board of Pacific Excel 2, LLC. He earned a Bachelor of Arts in Advertising from Southern Methodist University and a Master’s Degree in Management from the Stanford Graduate School of Business.

6

Mr. Venverloh brings to the Board valuable senior executive leadership experience and extensive digital media and advertising expertise. With senior management experience at a large public Internet company as well as service as an advisor to smaller digital media startups, Mr. Venverloh is well-positioned to advise the Board on a wide cross-section of new media matters.

James Keet Lewis

Mr. Lewis has been a Director of the Company since May 2014. Mr. Lewis is co-owner of Lewis Group International, which has since 1990 been involved in several new product introductions in the health and wellness industry. Mr. Lewis was also the founder and president of Cool Pool Solutions, Inc. and is co-developer of a patent on a swimming pool maintenance product, The Skimmer Basket Buddy. Most recently, Mr. Lewis has focused a significant amount of his consulting time on international energy projects. Mr. Lewis serves or has served on various political, ministry and charity boards, including the Christian Film and Television Commission, Liberty Institute, The Criswell College, Heritage Alliance, Heritage Alliance PAC, Texas Life Connections, Goodwill of Dallas, The Heidi Group, World Link Ministries, Dallas Council For Life and The Caring Peoples Network. Mr. Lewis currently serves as a trustee of Houston Christian Broadcasting, Inc., which operates 18 non-commercial Christian radio stations, including its flagship station KHCB, in Houston, Texas. He is also currently on the Board of Bott Radio Network in Kansas City, MO. Additionally, since 2009, Mr. Lewis has served on the Board of Hope for the Heart Ministries, a non-profit organization that is a customer of the Company. Mr. Lewis received his B.B.A. in 1977 from the University of Texas.

Mr. Lewis brings to the Board valuable leadership experience and relevant experience with our audience and programmers by virtue of his Board service on several political, charitable and ministry organizations.

Eric H. Halvorson

Mr. Halvorson has been an Attorney at the Law Office of Eric H. Halvorson since 2010 and focuses his practice on business law and estate planning. Mr. Halvorson is also of counsel to Stowell, Zeilenga, Ruth, Vaughn, and Treiger LLP, a boutique business law firm in Westlake Village. Mr. Halvorson has been an Adjunct Professor at the Pepperdine University School of Law for the 2006-2007, 2009-2010, 2010-2011, and 2013-2014 academic years. He was an Executive in Residence at Pepperdine University Seaver College of Letters, Arts and Sciences from 2000-2003 and from 2005-2007. Mr. Halvorson was President and Chief Operating Officer of the Company from 2007-2008, Chief Operating Officer from 1996-2000 and Executive Vice President of the Company from 1991-2000. From 1991-1999 and 1985-1988, Mr. Halvorson also served as General Counsel to the Company. Mr. Halvorson was the managing partner of the law firm of Godfrey & Kahn, S.C.-Green Bay from 1988 until 1991. From 1985 to 1988, he was Vice President and General Counsel of the Company. From 1976 until 1985, he was an associate and then a partner of Godfrey & Kahn, S.C.-Milwaukee. Mr. Halvorson was a Certified Public Accountant with Arthur Andersen & Co. from 1971 to 1973. Mr. Halvorson is a member of the Board of Directors of Intuitive Surgical, Inc., Friends of Spanish Hills, LLC and Spanish Hills Country Club. Mr. Halvorson was previously a Director of the Company from 1988-2008.

Mr. Halvorson brings valuable legal and financial expertise and extensive historical knowledge of the Company to the Board. He has also served as a Board member for several for-profit companies which enables him to bring relevant cross-Board experience to the Company.

Edward C. Atsinger

Edward C. “Ted” Atsinger is co-founder and Chief Operating Officer of Greytek, LLC, a counterintelligence and security services company focusing on the Defense and Industrial Security sectors. A veteran of multiple combat deployments, Mr. Atsinger dedicated himself to serving the interests of national security after the terrorist attacks of September 11, 2001, serving with distinction as a professional Counterintelligence Officer assigned to and supporting the United States Intelligence and Special Operations communities. Prior to his national security career, Mr. Atsinger worked as a Senior Producer in Salem's National News and Public Affairs Department. Mr. Atsinger holds a BA/MA (Oxon) in Philosophy and Theology from Oxford University, England. He has been a member of the Board of Directors of Rockbridge Academy, a classical Christian school in Millersville, Maryland since 2010. Mr. Atsinger is the son of Edward G. Atsinger III. Additionally, he is the nephew of Mr. Epperson and cousin of Director Nominee Stuart W. Epperson Jr.

7

Mr. Edward G. Atsinger III, the Company’s CEO, recommended Mr. Edward C. Atsinger’s nomination to the Company’s Board of Directors. It is anticipated that Mr. Atsinger will bring valuable senior executive leadership experience and business development experience to the Company.

Stuart W. Epperson Jr.

Stuart W. Epperson Jr. has been the Founder, President and CEO of Truth Broadcasting Corporation since its inception in 1998. Truth Broadcasting Corporation, which is a current customer of the Company, operates 21 signals in seven markets including Raleigh, Greensboro, Charlotte, Richmond, Salt Lake City, Des Moines and Myrtle Beach/Coastal Carolina in the following formats: Christian Talk (primary), Urban Gospel, Southern Gospel and Spanish. From 1995-1998 Mr. Epperson Jr. was a Senior Account Executive at Clear Channel Communications and from 1993-1995 was an Account Executive at Multimedia Radio, Inc. Mr. Epperson Jr. earned his B.A. in Communications from The Master’s College in 1992 and Master of Science, Broadcast Management from Bob Jones University in 1994. Mr. Epperson Jr. is the author of “Last Words of Jesus” published by Worthy Press Publ. in the spring of 2015 and his upcoming “First Words of Jesus” will be published by the same publisher in the fall of 2016. Additionally, Mr. Epperson Jr. currently sits on the Board of Directors for the National Religious Broadcasters, Persecution Project Foundation and Piedmont International University. Mr. Epperson Jr. is the son of Stuart W. Epperson, the nephew of Mr. Edward G. Atsinger III and cousin of Director Nominee Edward C. Atsinger.

Mr. Stuart W. Epperson, the Company’s Chairman of the Board, recommended Mr. Epperson Jr.’s nomination to the Company’s Board of Directors. It is anticipated that Mr. Epperson Jr. will bring valuable radio and senior executive leadership experience to the Company. In addition, Mr. Epperson Jr.’s operation of radio stations in similar formats to those of the Company will enable him to bring relevant experience related to our audiences and programmers.

Director Independence and Executive Sessions

The Company’s Board of Directors evaluated the independence of each of the Company’s Directors pursuant to the listing standards of the NASDAQ Stock Market (“NASDAQ Rules”). During this review, which included a review of the transactions and relationships described in the section of this Proxy Statement entitled “CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS” below, the Board of Directors considered various transactions and relationships among Directors (and their affiliates or family members), members of the Company’s senior management, affiliates and subsidiaries of the Company and certain other parties that occurred during the past three (3) fiscal years. This review was conducted to determine whether, under the NASDAQ Rules, any such relationships or transactions would affect the Board of Directors’ determination as to each director’s independence.

Upon conclusion of this review, the Board of Directors determined that, of the Directors nominated for election at the Annual Meeting, a majority of the Board (comprised of Messrs. Hinz, Riddle, Venverloh, Lewis and Halvorson) is independent of the Company and its senior management as required by the NASDAQ Rules.

The NASDAQ Rules also require that independent members of the Board of Directors meet periodically in executive sessions during which only independent Directors are present. The Company’s independent Directors have met separately in such executive sessions and in the future will regularly meet in executive sessions as required by the NASDAQ Rules.

8

Committees of the Board of Directors

The Company’s Board of Directors has three (3) committees: the Audit Committee, the Compensation Committee and the Nominating and Corporate Governance Committee. The following table identifies the independent members of the Board of Directors and lists the members and chairman of each of these committees:

| Name | Independent |

Audit Committee |

Compensation Committee |

Nominating and Corporate Governance Committee | ||||

| Stuart W. Epperson | ||||||||

| Edward G. Atsinger III | ||||||||

| Roland S. Hinz | I | X | C | |||||

| Richard A. Riddle | I | C | X | |||||

| Jonathan Venverloh | I | X | X | |||||

| James Keet Lewis | I | X | X | X | ||||

| Eric Halvorson | I | C | X |

I = Director is independent

X = Current member of committee

C = Current member and chairman of the committee

The Audit Committee of the Board of Directors (the “Audit Committee”) is a separately designated standing audit committee established in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The Audit Committee currently consists of Messrs. Halvorson (Chairman), Venverloh and Lewis, each of whom is independent under the NASDAQ Rules and applicable SEC rules and regulations. The Board of Directors has determined that Mr. Halvorson, the Audit Committee Chairperson, qualifies as an “audit committee financial expert” as defined by applicable SEC rules and regulations.

The Audit Committee held four (4) regularly scheduled meetings and two (2) special telephonic meetings in 2015 and operates under a written charter adopted by the Board of Directors. The Audit Committee and the Company’s Board of Directors annually (or more often as needed) review the charter to ensure it conforms to current laws and practices. This charter is available on the Company’s Internet website (http://salemmedia.com) and a copy of the charter may be obtained upon written request from the Secretary of the Company. Any information found on the Company’s website is not a part of, or incorporated by reference into, this or any other report of the Company filed with, or furnished to, the SEC.

The Audit Committee’s responsibilities are generally to assist the Board of Directors in fulfilling its legal and fiduciary responsibilities relating to accounting, audit and reporting policies and practices of the Company and its subsidiaries. The Audit Committee also, among other things, oversees the Company’s financial reporting process, retains and engages the Company’s independent registered public accounting firm, approves the fees for the Company’s independent registered public accounting firm, monitors and reviews the quality, activities and functions of the Company’s independent registered public accounting firm, and monitors the adequacy of the Company’s operating and internal controls and procedures as reported by management and the Company’s independent registered public accounting firm. The Audit Committee Report set forth later in this Proxy Statement provides additional details about the duties and activities of this committee.

As provided under applicable laws and rules, the Company’s Board of Directors delegates authority for compensation matters to the Compensation Committee of the Board of Directors (the “Compensation Committee”). The Compensation Committee’s membership is determined by the Board of Directors. The Compensation Committee currently consists of Messrs. Riddle (Chairman), Hinz and Lewis, each of whom is independent under the NASDAQ Rules, including recently adopted compensation committee independence requirements. The Compensation Committee is authorized to review and approve compensation, including non-cash benefits and severance arrangements for the Company’s Section 16 officers and employees and to approve salaries, remuneration and other forms of additional compensation and benefits as it deems necessary. The Compensation Committee also administers the Company’s Second Amended and Restated 1999 Stock Incentive Plan (the “Stock Plan”).

9

The Compensation Committee held two (2) regularly scheduled meetings in 2015. The Compensation Committee meets at least twice annually and at additional times as are necessary or advisable to fulfill its duties and responsibilities.

The role of the Company’s Compensation Committee is to oversee the Company’s compensation and benefit plans and policies, administer the Stock Plan (including reviewing and approving equity grants to elected officers), and to review and approve all compensation decisions relating to elected officers, including those for the Company’s Named Executive Officers (who are listed in the Summary Compensation Table below). In 2014 the actions of the Compensation Committee included reviewing objective benchmarks and metrics by which a Named Executive Officer’s performance can be measured and analyzing peer compensation and performance data for comparison with the Company’s Named Executive Officers. The Compensation Committee has delegated limited authority to Edward G. Atsinger III, the Company’s Chief Executive Officer, to grant up to $150,000 of options to purchase the Company’s Class A common stock annually (measured each calendar year without carry-over of unused grant authority from year to year). The $150,000 is calculated at a price equal to the price of the Company’s Class A common stock at the NASDAQ market close on the date the stock options are granted. This delegated authority is subject to prompt notification to the Compensation Committee of the issuance of any such grants and ratification of any such grants at the next regularly scheduled Compensation Committee meeting following the date of such grants.

The Company’s Named Executive Officers do not determine or approve any element or component of their own compensation. The Company’s CEO provides a recommendation to the Compensation Committee for base salary and annual incentive compensation for the Named Executive Officers reporting to him.

The Compensation Committee operates pursuant to a charter that was approved by the Board of Directors. The charter sets forth the responsibilities of the Compensation Committee. The Compensation Committee and the Company’s Board of Directors annually (or more often as needed) review the charter to ensure it conforms to current laws and practices. This charter is available on the Company’s Internet website (http://salemmedia.com) and a copy of the charter may be obtained from the Secretary of the Company upon written request. Any information found on the Company’s website is not a part of, or incorporated by reference into, this or any other report of the Company filed with, or furnished to, the SEC.

Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee of the Board of Directors (the “Nominating and Corporate Governance Committee”) currently consists of Messrs. Hinz (Chairman), Riddle, Venverloh, Lewis and Halvorson, each of whom is independent under the NASDAQ Rules. The Nominating and Corporate Governance Committee held three (3) regularly scheduled meetings and one (1) special telephonic meeting in 2015.

The Nominating and Corporate Governance Committee is authorized to: (a) develop and recommend a set of corporate governance standards to the Board of Directors for adoption and implementation; (b) identify individuals qualified to become members of the Board of Directors; (c) recommend that director nominees be elected at the Company’s next annual meeting of stockholders; (d) recommend nominees to serve on each standing committee of the Board of Directors; (e) lead in the annual review of Board performance and evaluation of the Board’s effectiveness; (f) ensure that succession planning takes place for the position of chief executive officer and other key Company senior management positions; and (g) analyze, review and, where appropriate, approve all related party transactions to which the Company or its subsidiaries or affiliates are a party, all in accordance with applicable rules and regulations.

To qualify as a nominee for service on the Board of Directors, a candidate must have sufficient time and resources available to successfully carry out the duties required of a Company Board member. The Nominating and Corporate Governance Committee desires to attract and retain highly qualified Directors who will diligently execute their responsibilities and enhance their knowledge of the Company’s core businesses and seeks Directors who possess some or all of the skills, qualifications and experience described under “Board Composition” in this Proxy Statement.

The Nominating and Corporate Governance Committee implements the Company’s policy regarding stockholder nominations by considering nominees for director positions that are made by the Company’s stockholders. Any stockholder desiring to make such a nomination must submit in writing the name(s) of the recommended nominee(s) to the Secretary of the Company at least 90 days prior but not earlier than 120 days prior to the first anniversary of the preceding annual meeting of stockholders. The written submission must also contain biographical information about the proposed nominee, a description of the nominee’s qualifications to serve as a member of the Board of Directors, and evidence of the nominee’s valid consent to serve as a director of the Company if nominated and duly elected.

10

The Company’s Directors provide oversight of the Company’s management and play a key role in shaping the strategic direction of the Company. Consistent with the Company’s Nominating and Corporate Governance Committee Charter, the Nominating and Corporate Governance Committee considers various criteria in Board candidates, including, the skills, qualifications and experience described under “Board Composition” in this Proxy Statement, as well as their appreciation of the Company’s core purpose, core values, and whether they have time available to devote to Board activities. The Nominating and Corporate Governance Committee also considers whether a potential nominee would satisfy:

| 1. | The criteria for director “independence” established by the NASDAQ Rules; and |

| 2. | The SEC’s definition of “audit committee financial expert.” |

Whenever a vacancy exists on the Board due to expansion of the Board’s size or the resignation, retirement or term expiration of an existing director, the Nominating and Corporate Governance Committee identifies and evaluates potential director nominees. The Nominating and Corporate Governance Committee considers recommendations of management, stockholders and others. The Nominating and Corporate Governance Committee has sole authority to retain and terminate any search firm to be used to identify director candidates, including approving its fees and other retention terms.

Director candidates are evaluated using the criteria described above and in light of the then-existing composition of the Board, including its overall size, structure, backgrounds and areas of expertise of existing Directors and the relative mix of independent and employee Directors. The Nominating and Corporate Governance Committee also considers the specific needs of the various Board committees. The Nominating and Corporate Governance Committee recommends potential director nominees to the full Board, and final approval of a candidate for nomination is determined by the full Board. This evaluation process is the same for Director nominees who are recommended by our stockholders.

The Board of Directors has adopted a written charter for the Nominating and Corporate Governance Committee. The Nominating and Corporate Governance Committee and the Company’s Board of Directors annually (or more often as needed) review the charter to ensure it conforms to current laws and practices. This charter is available on the Company’s Internet website (http://salemmedia.com) and a copy of the charter may be obtained upon written request from the Secretary of the Company. Any information found on the Company’s website is not a part of, or incorporated by reference into, this or any other report of the Company filed with, or furnished to, the SEC.

The Nominating and Corporate Governance Committee did not receive any recommendations from stockholders proposing candidate(s) for election at the Annual Meeting. None of the Directors serving on the Audit Committee, the Compensation Committee or the Nominating and Corporate Governance Committee are employees of the Company.

Although the Board does not have a formal policy on diversity, the Nominating and Corporate Governance Committee and the Board review from time-to-time the membership of the Board in light of the Company’s operations and strategic objectives and consider whether the current Board members possess the requisite skills, experience and perspectives to oversee the achievement of those goals. As part of an annual effectiveness review, the Nominating and Corporate Governance Committee evaluates the diversity of the Board composition to ensure that it sufficiently represents a diverse set of background, skills and experience.

Historically, the Company’s Board of Directors has had a general policy that the positions of Chairman of the Board and CEO should be held by separate persons as an aid in the Board’s oversight of management. This policy has been in effect since the Company began operations. The Chairman of the Board is a full-time senior executive of the Company. The duties of the Chairman of the Board include:

| • | presiding over all meetings of the Board; |

| • | preparing the agenda for Board meetings in consultation with the CEO and other members of the Board; |

| • | managing the Board’s process for annual Director self-assessment and evaluation of the Board and of the CEO; and |

| • | presiding over all meetings of stockholders. |

11

The Board of Directors believes that there are advantages to having a separate Chairman for matters such as communications and relations between the Board members, the CEO, and other senior management; in assisting the Board in reaching consensus on particular strategies and policies; and in facilitating robust director, Board, and CEO evaluation processes. In addition, having separate Chairman and CEO positions permits the CEO to focus on day-to-day business and allows the Chairman to lead the Board in its oversight responsibilities. The Board currently consists of the Chairman of the Board, the Company’s CEO, and five (5) independent Directors. One of Mr. Epperson’s roles is to oversee and manage the Board of Directors and its functions, including setting meeting agendas and running Board meetings. In this regard, Mr. Epperson and the Board in their advisory and oversight roles are particularly focused on assisting the CEO and senior management in seeking and adopting successful business strategies and risk management policies, and in making successful choices in management succession.

Board’s Role in Risk Oversight

The Company’s Board of Directors as a whole has responsibility for risk oversight, with reviews of certain areas being conducted by the relevant Board committees. These committees then provide reports to the full Board. The oversight responsibility of the Board and its committees is enabled by management reporting processes that are designed to provide visibility to the Board about the identification, assessment, and management of critical risks. These areas of focus include strategic, operational, financial and reporting, succession and compensation, legal and compliance, and other risks. The Board and its committees oversee risks associated with their respective areas of responsibility, as summarized above.

Director Attendance at Board and Committee Meetings and 2015 Annual Meeting of Stockholders

The full Board of Directors held four (4) regularly scheduled meetings and two (2) special telephonic meetings in 2015. During 2015, each of the Company’s incumbent Directors attended (either in person or telephonically) all of the regularly-scheduled meetings of the full Board of Directors, except that Mr. Venverloh did not attend one (1) special telephonic meeting. Each of the Company’s incumbent Directors attended more than seventy-five percent of the aggregate of the number of meetings of the Board and the total number of meetings held by all committees of the Board on which he served. The Company encourages, but does not require, that each Director attend the Company’s annual meeting of stockholders. In 2015, each of the Company’s then Directors attended the 2015 annual meeting of stockholders.

Communications between Stockholders and the Board

The Company has historically handled communications between stockholders and the Board of Directors on an ad hoc basis. No formal policy or process for such communications has been adopted by the Company as of the date of this Proxy Statement. The Company has, however, taken actions to ensure that the views of its stockholders are communicated to the Board or one or more of its individual Directors, as applicable. The Board considers its responsiveness to such communications as timely and exemplary.

The Company has adopted a financial code of conduct (“Financial Code of Conduct”) that applies to each Director of the Company, the Company’s principal executive officer, principal financial officer, principal accounting officer, controller and persons performing similar functions. This Financial Code of Conduct has been adopted by the Board as a “code of ethics” that satisfies applicable NASDAQ Rules. The Financial Code of Conduct is available on the Company’s Internet website (http://salemmedia.com) and a copy of the Financial Code of Conduct may be obtained free of charge upon written request from the Secretary of the Company. Any information found on the Company’s website is not a part of, or incorporated by reference into, this or any other report of the Company filed with, or furnished to, the SEC.

12

Set forth below are the executive officers of the Company, together with the positions held by those persons as of December 31, 2015. The executive officers are elected annually and serve at the pleasure of the Company’s Board of Directors; however, the Company has entered into employment agreements with each of the executive officers listed below. Certain payment provisions contained in the Company’s employment agreements with Messrs. Atsinger, Santrella and Evans are described under the section of this Proxy Statement entitled “EXECUTIVE COMPENSATION – Material Terms of NEO Employment Agreements Providing For Payment to NEOs Upon Termination” below.

| Name of Executive Officer | Age | Position(s) Held with the Company | ||

| Stuart W. Epperson | 79 | Chairman of the Board | ||

| Edward G. Atsinger III | 76 | Chief Executive Officer and Director | ||

| David A.R. Evans | 53 | President — New Media | ||

| David P. Santrella | 54 | President — Broadcast Media | ||

| Evan D. Masyr | 44 | Executive Vice President and Chief Financial Officer | ||

| Christopher J. Henderson | 52 | SVP, Legal and Human Resources, General Counsel and Secretary |

Set forth below is certain information concerning the business experience during the past five (5) years and other relevant experience of each of the individuals named above (excluding Messrs. Atsinger and Epperson, whose business experience is described in the section of this Proxy Statement entitled “THE BOARD OF DIRECTORS AND EXECUTIVE OFFICERS—Board of Directors” above).

David A. R. Evans

Mr. Evans has been President — New Media of the Company since September 2013. Mr. Evans was President—New Business Development, Interactive and Publishing of the Company from July 2007 to September 2013. Mr. Evans was Executive Vice President—Business Development and Chief Financial Officer of the Company from September 2005 to June 2007. Mr. Evans was Executive Vice President and Chief Financial Officer from September 2003 to September 2005. From 2000 to 2003, Mr. Evans served as the Company’s Senior Vice President and Chief Financial Officer. From 1997 to 2000, Mr. Evans served as Senior Vice President and Managing Director—Europe, Middle East, and Africa of Warner Bros. Consumer Products in London, England. He also served at Warner Bros. Consumer Products in Los Angeles, California, as Senior Vice President—Latin America, International Marketing, Business Development from 1996 to 1997 and Vice President—Worldwide Finance, Operations, and Business Development from 1992 to 1996. From 1990 to 1992, he served as Regional Financial Controller-Europe for Warner Bros. based in London, England. Prior to 1990, Mr. Evans was an audit manager with Ernst & Young LLP in Los Angeles, California and worked as a U.K. Chartered Accountant for Ernst & Young in London, England.

David P. Santrella

Mr. Santrella has been President — Broadcast Media of the Company since January 1, 2015, overseeing all broadcast operations involving the Company’s local radio stations, radio network and internal rep firm. From January 2010 to December 2014 he served as President — Radio Division of the Company. From October 2008 to December 31, 2009, he served as Operational Vice President over the Company’s Minneapolis, Denver and Colorado Springs clusters in addition to his existing responsibility over the Chicago cluster. From March 2006 to October 2008, Mr. Santrella was the Operational Vice President of Chicago and Milwaukee. In November of 2003, he was given additional oversight responsibility of Milwaukee. Mr. Santrella started with the Company in 2001 as the General Manager of the Company’s Chicago cluster.

Evan D. Masyr

Mr. Masyr has been Executive Vice President and Chief Financial Officer of the Company since January 2014. Prior to January 2014, Mr. Masyr was Senior Vice President and Chief Financial Officer of the Company since July 2007. Mr. Masyr was Vice President—Accounting and Finance of the Company from September 2005 to June 2007. From March 2004 to September 2005, Mr. Masyr was Vice President of Accounting and Corporate Controller of the Company. Prior to that time, Mr. Masyr was Vice President and Corporate Controller of the Company from January 2003 to March 2004. From February 2000 to December 2002, he served as the Company’s Controller. From 1993 to February 2000, Mr. Masyr worked for PricewaterhouseCoopers LLP (formerly, Coopers & Lybrand LLP). Mr. Masyr has been a Certified Public Accountant since 1995.

Christopher J. Henderson

Mr. Henderson has been Senior Vice President, Legal and Human Resources, General Counsel and Corporate Secretary of the Company since 2012. Prior to 2012, Mr. Henderson was Vice President, Legal and Human Resources, General Counsel and Corporate Secretary of the Company since March 2008. Mr. Henderson was Vice President, Human Resources of the Company from August 2006 to February 2008. From 2001 to August 2006, Mr. Henderson served as Corporate Counsel for the Company. Prior to joining the Company, Mr. Henderson worked for thirteen (13) years as an Attorney for Cooksey, Toolen, Gage, Duffy & Woog, first as a trial attorney and then as a transactional attorney.

13

COMPENSATION DISCUSSION & ANALYSIS

The Company’s Executive Compensation Philosophy

The Board of Directors of the Company believes that a key to the Company’s current and future success is its ability to attract and retain qualified individuals who are committed to the Company’s success and capable of delivering on such commitment. The Company’s compensation and benefits programs are designed to enable the attraction, retention and motivation of the best possible employees to operate and manage the Company at all levels. At the same time, the Board of Directors of the Company is committed to a compensation policy for the Company’s executive management that is appropriately transparent to the Company’s stockholders and in alignment with stockholders’ best interests.

The Company’s executive compensation programs are based upon a pay-for-performance philosophy that provides incentives to achieve both short-term and long-term objectives and to reward both individual and Company performance. In addition to evaluating performance using financial and operational metrics, the CEO, CFO and the Company’s three other most highly compensated executive officers during 2015 (collectively, the “Named Executive Officers”) are evaluated in many areas that are not measured directly by financial or operational results. These areas include: (i) how well each Named Executive Officer helps the Company to achieve its strategic goals; (ii) each executive’s ability to develop his or her subordinates; and (iii) each executive’s efforts to enhance the Company’s relationship with key stakeholders. In 2015, the Company’s Named Executive Officers were Mr. Atsinger, Chief Executive Officer; Mr. Masyr, Executive Vice President and Chief Financial Officer; Mr. Evans, President – New Media; Mr. Santrella, President – Broadcast Media; and Mr. Henderson, SVP, Legal and Human Resources, General Counsel and Secretary.

Benchmarking

It is the intent of the Board of Directors that the Company be in a position to compete for highly qualified employees, including its Named Executive Officers. Accordingly, the process for compensation determination involves the Committee’s consideration of peer compensation levels. While the Committee does not have a formal policy regarding benchmarking, when determining recommended salary, target bonus levels and target annual long-term incentive award values for Named Executive Officers, the Committee gives consideration to compensation practices at peer radio media companies, based on available data.

Consideration of Say-on-Pay Vote Results

We value the feedback provided by our shareholders regarding executive compensation. Shareholders are provided with the opportunity to cast an advisory vote on executive compensation once every three (3) years and the Compensation Committee considers the results of such vote when making compensation decisions for the Named Executive Officers. At Salem’s 2013 annual meeting of shareholders, shareholders indicated their support for the compensation of our Named Executive Officers, with approximately 96% of the votes cast on the say-on-pay proposal voted for the proposal. The next shareholder advisory vote will be held at this Annual Meeting. The Compensation Committee will continue to consider the results of say-on-pay votes when making future compensation decisions for the Company’s Named Executive Officers.

Named Executive Officer Compensation

The Company’s Named Executive Officer compensation consists of four elements: (1) base salary; (2) annual cash incentive (bonus) awards; (3) long-term incentive compensation, usually in the form of stock options; and (4) perquisites and benefits. The Committee assesses each of these elements independently from the other elements to ensure that the amount paid to each Named Executive Officer for each compensation element is reasonable and, as a function of overall compensation paid, ensures that compensation for each Named Executive Officer is reasonable in its totality.

Employment Agreements

Each of the Company’s Named Executive Officers except Mr. Atsinger is employed pursuant to “at will” employment agreements without a fixed term length. Mr. Atsinger is employed pursuant to an employment agreement with a fixed three year term. Each of the Named Executive Officer employment agreements provides for a contractual rate of base salary to be paid during the first three years of the contract length. Mr. Atsinger’s current agreement was entered into as of July 1, 2013, and will expire on June 30, 2016. Mr. Masyr’s current agreement was entered into as of January 1, 2014, and the contractual rate of base salary will expire on December 31, 2016. Mr. Evans’ current agreement was entered into as of September 15, 2014, and the contractual rate of base salary will expire on September 14, 2017. Mr. Santrella’s current agreement was entered into as of January 1, 2014, and the contractual rate of base salary will expire on December 31, 2016. Mr. Henderson’s current agreement was entered into as of July 1, 2015, and the contractual rate of base salary will expire on June 30, 2018.

14

Base Salary

When determining recommended base salaries for the Company’s Named Executive Officers, the Committee generally evaluates salaries of the peer companies described in the section of this Proxy Statement entitled “COMPENSATION DISCUSSION & ANALYSIS—General Discussion—Benchmarking” above.

Where appropriate, adjustments are made to reflect the Company’s relative position within the peer group. The Committee also considers other factors including: (i) individual contribution and performance; (ii) Company performance; (iii) market conditions; (iv) retention needs; (v) experience; (vi) succession planning; (vii) historic practices; and (viii) internal equity.

Increases in the base salaries of the Company’s Named Executive Officers for 2015 were made pursuant to the terms of the agreements described in the section of this Proxy Statement entitled “COMPENSATION DISCUSSION & ANALYSIS—Named Executive Officer Compensation—Employment Agreements” above.

Annual Cash Incentive (Bonus) Awards

All of the Company’s Named Executive Officers are eligible to receive discretionary bonuses. The amount to be paid as a bonus, if any, to any Named Executive Officer is determined after a review of the Company’s performance and the performance of each individual Named Executive Officer. Ordinarily, this determination is made in the first quarter of each year, following completion of the Company’s financial statements for the prior year.

Incentive Compensation Pool

Annual cash incentive (bonus) awards are granted to Named Executive Officers from a target cash incentive (bonus) pool which is established at the beginning of the prior year. Over the course of such year the Committee adjusts the size of the pool to reflect the financial performance of the Company. Although the Company may pay an aggregate amount of annual cash incentive (bonus) award that is less than the full amount set forth in the pool, it generally does not pay and has not paid an aggregate amount that is greater than that which is in the pool.

Performance Measures and Award Payments

The Committee considers many factors when assessing the amount of any Named Executive Officer’s annual cash incentive (bonus) awards. The Committee has significant flexibility in awarding cash bonuses. The Company believes that this flexibility, and the Company’s history of rewarding performance, provide a strong motivating incentive to the Company’s Named Executive Officers to perform in a manner that will help the Company continue to achieve its goals and objectives.

Given the changing nature and complexities of the media industry, the Committee’s decision to increase or decrease cash bonuses from year to year is generally based upon a variety of factors deemed appropriate by the Committee including the financial performance of the Company and the individual areas of responsibility of each Named Executive Officer. The Committee has broad discretion to make bonus determinations and it is not required to apply formulas or ranges based upon specific performance criteria. Factors generally considered by the Committee include: (i) earnings per share; (ii) return on invested capital; (iii) EBITDA growth; (iv) same station revenue growth; (v) same station operating income growth; (vi) non-broadcast EBITDA; (vii) relative stock price growth; and (viii) audience growth.

Incentive (Bonus) Awards Paid in 2015

Based on the financial performance of the Company, the Committee’s consideration of the factors described in the section of this Proxy Statement entitled “COMPENSATION DISCUSSION & ANALYSIS—Named Executive Officer Compensation—Performance Measures and Award Payments” above, and Company management’s recommendations, the actual bonuses paid to each Named Executive Officer in 2015 for performance in 2014 were $300,000 for Mr. Atsinger, $60,000 for Mr. Masyr, $98,000 for Mr. Evans plus $20,000 for achievement of specific, pre-determined revenue goals, $88,000 for Mr. Santrella and $60,000 for Mr. Henderson.

15

Long-Term Incentive Compensation

The Company believes that equity-based compensation helps ensure that the interests of the Named Executive Officers are aligned with those of the Company’s stockholders. The Company also believes that equity-based compensation is a material element of compensation required to recruit and retain key executives and remain competitive with the Company’s peers. Lastly, the Company uses equity-based compensation, in particular stock options with long-term vesting, to incentivize long-term retention of key executives.

Stock Options

The Company’s equity-based compensation program is governed by the 1999 Stock Incentive Plan (as amended and restated through March 4, 2015) (“Stock Plan”). The Stock Plan calls for stock options to be granted with exercise prices equal to the market price of the Company’s class A common stock on the date of grant. All stock options granted by the Company generally have value only if the market price of the class A common stock has increased by the time the options vest and are exercised. The Company’s option grants generally vest ratably over four years. Because the stock options do not have value unless the stock price increases above the grant date price, the Committee believes that stock options are a useful motivational tool.

In determining the size of stock option grants to Named Executive Officers, the Committee: (i) compares equity-based compensation awards to individuals holding comparable positions in the Company’s peer group; (ii) evaluates the Black-Scholes valuation of potential stock option grants; (iii) reviews Company performance against annual performance goals; and (iv) reviews individual performance against the individual’s annual incentive bonus objectives.

In 2015 the Committee decided not to make any stock option grants, but anticipates it will make stock option grants as part of executive compensation in the future.

The Company provides its Named Executive Officers with perquisites and employee benefits. Except as specifically noted elsewhere in this Proxy Statement, the employee benefits programs in which the Company’s Named Executive Officers participate (which provide benefits such as medical coverage, dental coverage, life insurance, disability insurance and annual contributions to a qualified 401(k) retirement plan) are generally the same programs offered to substantially all of the Company’s salaried employees.

Perquisites

The Committee does not view perquisites as a significant element of its overall compensation structure, but it does believe that providing perquisites can be a useful tool in attracting, motivating and retaining executive talent. The Company provided certain perquisites to its Named Executive Officers in 2015 as summarized below:

Use of Vehicles

Mr. Atsinger is provided a vehicle by the Company. The Committee made its determination to provide Mr. Atsinger with such perquisite based upon: (i) the fact that this perquisite has been given to this executive for many years, and (ii) a comparison of comparable perquisites for similar positions at peer companies.

Supplemental Medical, Travel and Expense Reimbursement for Mr. Atsinger