SCHEDULE 14A INFORMATION

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ Preliminary Proxy Statement |

¨ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| x Definitive Proxy Statement |

||

| ¨ Definitive Additional Materials | ||

| ¨ Soliciting Material Pursuant to Rule 14a-11(c) or Rule 14a-12 | ||

SALEM COMMUNICATIONS CORPORATION

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

4880 Santa Rosa Road

Camarillo, CA 93012

(805) 987-0400

April 26, 2004

Dear Stockholder:

You are cordially invited to attend the 2004 Annual Meeting of Stockholders (the “Annual Meeting”) of Salem Communications Corporation (“Salem”). The Annual Meeting is scheduled to be held on Thursday, June 10, 2004, at the Hyatt Westlake Plaza, 880 South Westlake Boulevard, Westlake Village, California, at 9:30 a.m. local time. As described in the accompanying Notice of Annual Meeting of Stockholders and Proxy Statement, the agenda for the Annual Meeting includes:

| (1) | the annual election of all eight Salem directors, and |

| (2) | a proposal to ratify the appointment of Ernst & Young LLP as our independent auditors for 2004. |

The board of directors recommends that you vote FOR the election of the slate of director nominees and FOR ratification of appointment of the recommended independent auditors. Please refer to the Proxy Statement for detailed information on each of the proposals. Directors and executive officers of Salem will be present at the Annual Meeting to respond to questions that our stockholders may have regarding the business to be transacted.

We urge you to vote your proxy as soon as possible. Your vote is very important, regardless of the number of shares you own. Whether or not you plan to attend the Annual Meeting in person, we urge you to sign, date and return the enclosed proxy card promptly in the accompanying postage prepaid envelope. You may, of course, attend the Annual Meeting and vote in person even if you have previously returned your proxy card.

On behalf of the board of directors and all of the employees of Salem, we wish to thank you for your support.

Sincerely yours,

STUART W. EPPERSON

Chairman of the Board

EDWARD G. ATSINGER III

President and Chief Executive Officer

If you have any questions concerning the Proxy Statement or the accompanying proxy card, or if you need any help in voting your shares, please telephone Jonathan L. Block of Salem at (805) 987-0400.

PLEASE SIGN, DATE AND RETURN

THE ENCLOSED PROXY CARD TODAY.

4880 Santa Rosa Road

Camarillo, CA 93012

(805) 987-0400

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held on June 10, 2004

NOTICE IS HEREBY GIVEN that the 2004 Annual Meeting of Stockholders (the “Annual Meeting”) of Salem Communications Corporation (“Salem”) will be held on Thursday, June 10, 2004, at the Hyatt Westlake Plaza, 880 South Westlake Boulevard, Westlake Village, California, at 9:30 a.m. local time, subject to adjournment or postponement by the board of directors, for the following purposes:

| 1. | To elect eight persons to the board of directors to serve until the next annual meeting of stockholders or until their respective successors are duly elected and qualified; |

| 2. | To ratify the selection of Ernst & Young LLP as Salem’s independent auditors for the fiscal year ending December 31, 2004; and |

| 3. | To transact such other business as may properly come before the Annual Meeting or any adjournments or postponements thereof. |

Only holders of record of Salem’s Class A common stock, par value $0.01 per share, and Class B common stock, par value $0.01 per share, on April 16, 2004, are entitled to notice of, and to vote at, the Annual Meeting and any adjournments or postponements thereof. A list of such stockholders will be available for examination by any stockholder at the time and place of the Annual Meeting.

Holders of a majority of the voting power of the outstanding shares of the Class A common stock and of the Class B common stock must be present in person or by proxy in order for the Annual Meeting to be held. Therefore, we urge you to date, sign and return the accompanying proxy card in the enclosed postage prepaid envelope whether or not you expect to attend the Annual Meeting in person. If you attend the Annual Meeting and wish to vote your shares personally, you may do so by validly revoking your proxy as described below.

Prior to the voting thereof, a proxy may be revoked by the person executing such proxy by: (i) filing with the Secretary of Salem, prior to the commencement of the Annual Meeting, either a duly executed written notice dated subsequent to such proxy revoking the same or a duly executed proxy bearing a later date, or (ii) attending the Annual Meeting and voting in person.

If you plan to attend the Annual Meeting, we would appreciate your response by indicating so at the appropriate box on the enclosed proxy card.

By order of the board of directors

JONATHAN L. BLOCK

Secretary

Camarillo, California

April 26, 2004

YOUR VOTE IS IMPORTANT.

TO VOTE YOUR SHARES, PLEASE SIGN AND DATE THE ENCLOSED PROXY

CARD AND MAIL IT PROMPTLY IN THE ENCLOSED RETURN ENVELOPE.

| Page No. | ||

| 1 | ||

| 1 | ||

| 1 | ||

| 2 | ||

| 2 | ||

| 2 | ||

| 3 | ||

| 5 | ||

| 6 | ||

| 6 | ||

| 7 | ||

| 7 | ||

| Board Meetings and Director Attendance at 2003 Annual Stockholder’s Meeting |

8 | |

| 8 | ||

| 8 | ||

| 9 | ||

| 9 | ||

| 9 | ||

| 9 | ||

| 9 | ||

| 11 | ||

| 11 | ||

| 12 | ||

| Securities Authorized for Issuance Under Equity Compensation Plans |

12 | |

| 13 | ||

| 13 | ||

| 14 | ||

| 14 | ||

| 14 | ||

| 15 | ||

| 15 | ||

| 17 | ||

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT |

18 | |

| 20 | ||

| 20 | ||

| 20 | ||

| 20 | ||

| 21 | ||

| 21 | ||

| 21 | ||

| 21 | ||

| 21 | ||

| 21 | ||

| 21 | ||

| 22 | ||

| 22 | ||

| 23 | ||

| 23 | ||

| 23 |

i

| Page No. | ||

| THE COMPANY’S RELATIONSHIP WITH ITS INDEPENDENT PUBLIC ACCOUNTANTS |

23 | |

| 23 | ||

| 24 | ||

| 24 | ||

| 24 | ||

| 24 | ||

| 24 | ||

| 25 | ||

| 25 | ||

| 26 | ||

| 27 |

ii

SALEM COMMUNICATIONS CORPORATION

4880 Santa Rosa Road

Camarillo, CA 93012

(805) 987-0400

PROXY STATEMENT

ANNUAL MEETING OF STOCKHOLDERS

To Be Held on June 10, 2004

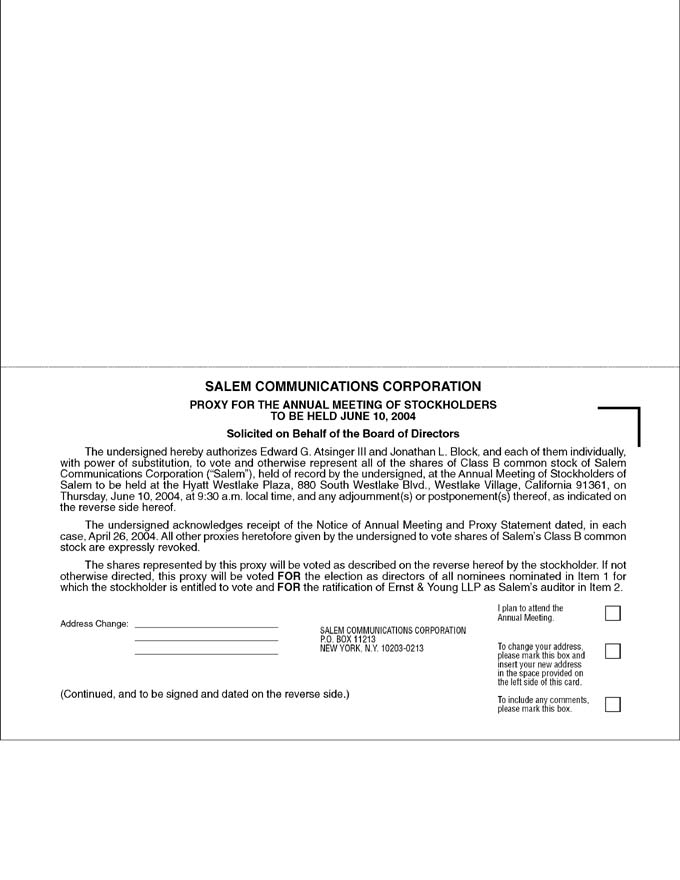

This Proxy Statement is furnished in connection with the solicitation by the board of directors (the “board” or the “board of directors”) of Salem Communications Corporation, a Delaware corporation (“Salem” or the “company”), of proxies for use at the 2004 Annual Meeting of Stockholders of the company (the “Annual Meeting”) scheduled to be held at the time and place and for the purposes set forth in the accompanying Notice of Annual Meeting of Stockholders. The approximate date on which this Proxy Statement and the enclosed proxy card are first being sent to stockholders is April 26, 2004.

INFORMATION REGARDING VOTING AT THE ANNUAL MEETING

At the Annual Meeting, the stockholders of the company are being asked to consider and to vote upon the following proposals:

| Proposal 1 | The election of the eight directors nominated by the company’s board of directors to serve until the annual meeting of stockholders to be held in the year 2005 or until their respective successors are duly elected and qualified. | |

| Proposal 2 | To ratify the selection of Ernst & Young LLP as Salem’s independent auditors for the fiscal year ending December 31, 2004. | |

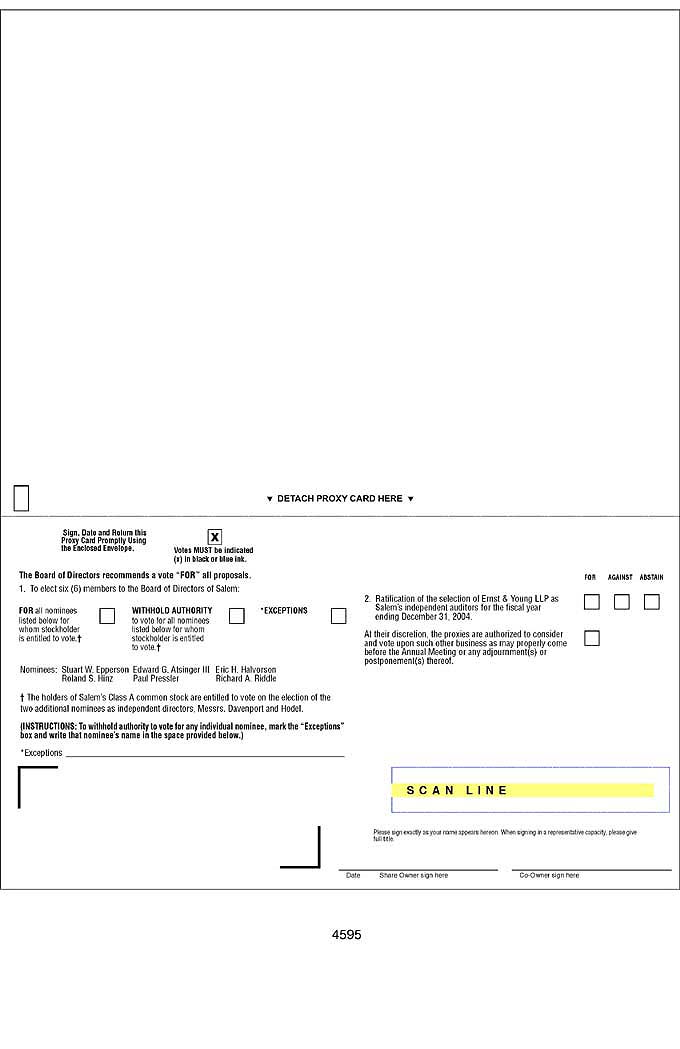

For information regarding these proposals, see the sections of this Proxy Statement entitled “PROPOSAL 1—ELECTION OF DIRECTORS,” and “PROPOSAL 2—RATIFICATION OF SELECTION OF INDEPENDENT AUDITORS.” Shares represented by properly executed proxies received by the company will be voted at the Annual Meeting in the manner specified therein or, if no instructions are marked on the enclosed proxy card, FOR each of the director nominees identified on such proxy card for such directors, and FOR ratification of appointment of the independent auditors, as the holder of such shares is entitled to vote. Although management does not know of any matter other than the two proposals described above to be acted upon at the Annual Meeting, unless contrary instructions are given, shares represented by valid proxies will be voted by the persons named on the accompanying proxy card in accordance with their respective best judgment in respect of any other matters that may properly be presented for a vote at the Annual Meeting.

Execution of a proxy will not in any way affect a stockholder’s right to attend the Annual Meeting and vote in person, and any person giving a proxy has the right to revoke it at any time before it is exercised by: (i) filing with the Secretary of Salem, prior to the commencement of the Annual Meeting, either a duly executed written notice dated subsequent to such proxy revoking the same or a duly executed proxy bearing a later date, or (ii) attending the Annual Meeting and voting in person.

1

The mailing address of the principal executive offices of the company is 4880 Santa Rosa Road, Camarillo, California 93012, and its telephone number is (805) 987-0400.

Record Date, Quorum and Voting

Only stockholders of record on April 16, 2004 (the “Record Date”), will be entitled to notice of and to vote at the Annual Meeting. There were outstanding on the Record Date 17,990,417 shares of Class A common stock, par value $0.01 per share (“Class A common stock”), and 5,553,696 shares of Class B common stock, par value $0.01 per share (“Class B common stock”), of the company (the Class A common stock and the Class B common stock are collectively referred to as the “common stock”). Each share of outstanding Class A common stock is entitled to one vote on each matter to be voted on at the Annual Meeting and each share of outstanding Class B common stock is entitled to ten votes on each matter to be voted on at the Annual Meeting, except that, as provided in the company’s Amended and Restated Certificate of Incorporation, the holders of Class A common stock shall be entitled to vote as a class, exclusive of the holders of the Class B common stock, to elect two “Independent Directors.” The two Independent Directors shall be elected by a plurality of the votes of the shares of Class A common stock present in person or represented by proxy and entitled to vote on the election of the Independent Directors; the remaining six directors will be elected by a plurality of the votes of the shares of Class A common stock and Class B common stock present in person or represented by proxy and entitled to vote on the election of such directors. For information regarding the election of the Independent Directors, see the section of this Proxy Statement entitled “PROPOSAL 1—ELECTION OF DIRECTORS.”

The presence, in person or by proxy, of the holders of at least a majority of the voting power of the common stock issued and outstanding and entitled to vote is necessary to constitute a quorum at the Annual Meeting. In the event there are not sufficient votes for a quorum at the time of the Annual Meeting, the Annual Meeting may be adjourned in order to permit the further solicitation of proxies.

Under Delaware law and the company’s Amended and Restated Certificate of Incorporation and Bylaws, abstentions and broker non-votes are counted for the purpose of determining the presence or absence of a quorum for the transaction of business. With regard to the election of directors and the proposal to ratify the appointment of our independent auditors, votes may be cast in favor or withheld; votes that are withheld will be excluded entirely from the vote and will have no effect. Abstentions are counted in tabulations of the votes cast on proposals presented to stockholders other than the election of directors, thus having the effect of a negative vote, whereas broker non-votes are not counted for purposes of determining whether a proposal has been approved. Any stockholder proposals that properly come before the Annual Meeting require, in general, the affirmative vote of a majority of the voting power of the shares of Class A common stock and Class B common stock present, in person or represented by proxy, at the Annual Meeting and entitled to vote on the subject matter.

The cost of preparing, assembling and mailing the Notice of Annual Meeting of Stockholders, this Proxy Statement and the enclosed proxy card will be paid by the company. Following the mailing of this Proxy Statement, directors, officers and other employees of the company may solicit proxies by mail, telephone, facsimile or other electronic means or by personal interview. Such persons will receive no additional compensation for such services. Brokerage houses and other nominees, fiduciaries and custodians nominally holding shares of Class A common stock of record will be requested to forward proxy soliciting material to the beneficial owners of such shares, and will be reimbursed by the company for their reasonable charges and expenses in connection therewith.

With regard to the delivery of Annual Reports and Proxy Statements, under certain circumstances the Securities and Exchange Commission (“SEC”) permits a single set of such documents to be sent to any

2

household at which two or more stockholders reside if they appear to be members of the same family. Each stockholder, however, still receives a separate proxy card. This procedure, known as “householding,” reduces the amount of duplicate information received at a household and reduces mailing and printing costs as well. A number of banks, brokers and other firms have instituted householding and have previously sent a notice to that effect to certain of the company’s stockholders whose shares are registered in the name of such bank, broker or other firm. As a result, unless the stockholders receiving such notice gave contrary instructions, only one Annual Report and/or Proxy Statement, as applicable, will be mailed to an address at which two or more stockholders reside. If any stockholder residing at such an address wishes to receive a separate Annual Report or Proxy Statement in the future, such stockholder should telephone toll-free 1-800-542-1061. In addition, if any stockholder who previously consented to householding desires to receive a separate copy of a Proxy Statement or Annual Report, as applicable, for each stockholder at his or her same address, such stockholder should contact his or her bank, broker or other firm in whose name the shares are registered or contact the company at the address or telephone number listed on page of this Proxy Statement.

The following table sets forth certain information as of April 26, 2004, except where otherwise indicated, with respect to the directors of the company. Each of the directors of the company serves a one-year term and all directors are subject to re-election at each annual meeting of stockholders.

| Name of Director |

Age |

First Became Director of Company |

Position Held with the Company | |||

| Stuart W. Epperson |

67 | 1986 | Chairman of the Board | |||

| Edward G. Atsinger III |

64 | 1986 | President, Chief Executive Officer and Director | |||

| David Davenport |

53 | 2001 | Director | |||

| Eric H. Halvorson |

55 | 1988 | Director | |||

| Roland S. Hinz |

65 | 1997 | Director | |||

| Donald P. Hodel |

68 | 1999 | Director | |||

| Judge Paul Pressler |

73 | 2002 | Director | |||

| Richard A. Riddle |

59 | 1997 | Director |

Set forth below is certain information concerning the principal occupation and business experience of each of the directors during the past five years and other relevant experience.

Stuart W. Epperson

Mr. Epperson has been Chairman of Salem since its inception. He is also a director of Salem Communications Holding Corporation, a wholly-owned subsidiary of Salem. Mr. Epperson has been engaged in the ownership and operation of radio stations since 1961. In addition, he is a member of the board of directors of the National Religious Broadcasters. Mr. Epperson is married to Nancy A. Epperson who is Mr. Atsinger’s sister.

Edward G. Atsinger III

Mr. Atsinger has been President, Chief Executive Officer and a director of Salem and a director of each of Salem’s subsidiaries since their inception. He has been engaged in the ownership and operation of radio stations since 1969. Mr. Atsinger has been a member of the board of directors of the National Religious Broadcasters for a number of years; he was re-elected to a three-year term on that board in February 2004. Mr. Atsinger is also a member of the board of directors of Truth For Life, an non-profit corporation that is a customer of the company. Mr. Atsinger is the brother-in-law of Mr. Epperson.

3

David Davenport

Mr. Davenport has been a director of Salem since November 2001. Mr. Davenport is a distinguished professor of public policy and law at Pepperdine University and has served in that position since August 2003. He is also a research fellow at the Hoover Institution and has served in that position since August 2001. Mr. Davenport was the Chief Executive Officer of Starwire Corporation, a software service company formerly known as Christianity.com, from June 2000 to June 2001. Mr. Davenport served as President of Pepperdine University from 1985 to 2000. From 1980 through 1985, he served as a Professor of Law, General Counsel, and Executive Vice President of the University. Mr. Davenport currently serves on the governing and advisory boards of Hope Network Ministries, Forest Lawn Memorial Parks Association and National Legal Center for the Public Interest. He also serves on advisory boards of Clark/Bardes, Inc. and Inside Track. Mr. Davenport also serves on the board of directors of Ameron International Corporation.

Eric H. Halvorson

Mr. Halvorson has been a director of Salem since 1988. Mr. Halvorson is currently the President and Chief Executive Officer of The Thomas Kincade Company (formerly Media Arts Group, Inc.) and has served in these positions since 2003. Mr. Halvorson was a Visiting Professor at Pepperdine University from 2000 to 2003. Mr. Halvorson was Chief Operating Officer of Salem from 1995 to 2000 and Executive Vice President of the company from 1991 to 2000. From 1991 to 2000, Mr. Halvorson also served as General Counsel to the company. Mr. Halvorson was the managing partner of the law firm of Godfrey & Kahn, S.C.-Green Bay from 1988 until 1991. From 1985 to 1988, he was Vice President and General Counsel of Salem. From 1976 until 1985, he was an associate and then a partner of Godfrey & Kahn, S.C.-Milwaukee. Mr. Halvorson was a Certified Public Accountant with Arthur Andersen & Co. from 1971 to 1973. Mr. Halvorson is currently a member of the board of directors of Intuitive Surgical, Inc.

Roland S. Hinz

Mr. Hinz has been a director of Salem since September 1997. Mr. Hinz has been the owner, President and Editor-in-Chief of Hi-Torque Publishing Company, a publisher of magazines covering the motorcycling and biking industries, since 1982. Mr. Hinz is also the managing member of Hi-Favor Broadcasting, LLC, the licensee of radio station KLTX-AM, Long Beach, California, and KEZY-AM, San Bernardino, California (which were acquired from Salem in August 2000 and December 2001, respectively), and radio station KSDO-AM, San Diego, California. Mr. Hinz also serves on the board of directors of the Association of Community Education, Inc., a not-for-profit corporation operating radio station KLTX-AM, Long Beach, California, and KEZY-AM, San Bernardino, California. Mr. Hinz also serves on the board of directors of Truth for Life, non-profit organization that is a customer of the company.

Donald P. Hodel

Mr. Hodel has been a director of Salem since May 1999. Mr. Hodel is a founder and has been the Managing Director of Summit Group International, Ltd., an energy and natural resources consulting firm, since 1989. He has served as Vice Chairman of Texon Corporation, an oil and natural gas marketing company, since 1994. On May 15, 2003, Mr. Hodel became President and Chief Executive Officer of Focus on the Family, a non-profit organization that is a customer of the company. Mr. Hodel has served on the board of directors of Focus on the Family intermittently since 1995. Previously, Mr. Hodel served as Executive Vice President of Focus on the Family from January 1996 to August 1996. In addition to serving as a director of Focus on the Family, Mr. Hodel currently serves on the boards of directors of Integrated Electrical Services, Inc., the North American Electric Reliability Council and Eagle Publishing, Inc., and has previously served on the boards of a number of public companies. Mr. Hodel served as President of the Christian Coalition from June 1997 to January 1999. During the Reagan Administration, Mr. Hodel served as Secretary of Energy and Secretary of the Interior.

4

Judge Paul Pressler

Judge Pressler has been a director of Salem since March 2002, and is also a board member of the Free Market Foundation and KHCB Network, a non-profit corporation which owns Christian radio stations in Texas and Louisiana, and a board member of National Religious Broadcasters. He has been an active leader in the Southern Baptist Convention. Additionally, he is a member of the Texas Philosophical Society, the General Counsel of the Baptist World Alliance, and a member of the State Republican Executive Committee of Texas. Since 2000, Judge Pressler has been a partner in the law firm of Woodfill & Pressler, a director of Revelation, Inc., and has been in private mediation practice for several years as well. A retired justice of the Texas Court of Appeals, Judge Pressler was appointed Justice of the Texas Court of Appeals in 1978, serving until 1992. Judge Pressler also served as District Judge from 1970 to 1978. From 1958 to 1970, he was associated with the law firm of Vinson & Elkins.

Richard A. Riddle

Mr. Riddle has been a director of Salem since September 1997. Mr. Riddle is an independent businessman specializing in providing financial assistance and consulting to individuals and manufacturing companies. Since 1991, he has been the President of Richray Industries, a holding company for various manufacturing companies. He was President and a majority stockholder of I. L. Walker Company from 1988 to 1997 when that company was sold. He also was Chief Operating Officer and a major stockholder of Richter Manufacturing Corp. from 1970 to 1987.

Director Independence and Executive Sessions

In March 2004, the company’s board of directors evaluated the independence of each of Salem’s directors pursuant to standards set forth in the listing regulations of the National Association of Securities Dealers, Inc., as approved by the Securities and Exchanges Commission (“NASDAQ Rules”). During this review, the board of directors considered various transactions and relationships among directors (and their affiliates or family members), members of the company’s senior management, affiliates and subsidiaries of the company and certain other parties that occurred during the past three fiscal years. This review was conducted to determine whether, under the NASDAQ Rules, any such relationships or transactions would affect the board of directors’ determination as to each director’s independence from management.

Upon conclusion of this review, the board of directors determined that, of the directors nominated for election at the Annual Meeting, a majority of the board (comprised of Messrs. Davenport, Hinz, Hodel, Pressler and Riddle) is independent of Salem and its senior management as required by the NASDAQ Rules.

The NASDAQ Rules also require that independent members of the board of directors meet periodically in executive sessions during which only independent directors are present. The company’s independent directors have met separately in such executive sessions and in the future will regularly meet in executive sessions as required by the NASDAQ Rules.

5

Committees of the Board of Directors

The company’s board of directors has three committees: the Audit Committee, the Compensation Committee and the Nominating and Corporate Governance Committee. The following table lists the members and chairman of each of these committees:

COMMITTEE MEMBERSHIP

| Name |

Independent |

Audit Committee |

Compensation Committee |

Nominating and Corporate Governance Committee | ||||

| Stuart W. Epperson |

||||||||

| Edward G. Atsinger III |

||||||||

| David Davenport |

X | X | X | |||||

| Eric H. Halvorson |

X | |||||||

| Roland S. Hinz |

X | C | X | |||||

| Donald P. Hodel |

X | X | X | |||||

| Judge Paul Pressler |

X | C | ||||||

| Richard A. Riddle |

X | C | X | X |

| X | = Current member of committee. |

| C | = Current member and chairman of the committee |

The Audit Committee currently consists of Messrs. Riddle (Chairman), Halvorson and Hodel. The board of directors has determined that Mr. Riddle, the Audit Committee Chairperson, is independent under the NASDAQ Rules and qualifies as an “audit committee financial expert,” as defined and required by applicable SEC rules and regulations.

The Audit Committee met five times in 2003 and operates under a written charter adopted by the board of directors, a copy of which was attached as appendix A to the company’s Proxy Statement filed with the SEC on April 29, 2003. This charter is also available on Salem’s Internet website (www.salem.cc) and a copy of the charter may be obtained upon written request from the Secretary of the company. Any information found on the company’s website is not a part of, or incorporated by reference into, this or any other report of the company filed with, or furnished to, the SEC.

The Audit Committee’s responsibilities are generally to assist the board in fulfilling its legal and fiduciary responsibilities relating to accounting, audit and reporting policies and practices of the company and its subsidiaries. The Audit Committee also, among other things, oversees the company’s financial reporting process, recommends to the board of directors the engagement of the company’s independent auditors, approves the fees for the independent auditors, monitors and reviews the quality, activities and functions of its independent auditors, and monitors the adequacy of the company’s operating and internal controls and procedures as reported by management and internal auditors. The Audit Committee Report set forth later in this Proxy Statement provides additional details about the duties and activities of this committee.

All members of the Audit Committee, except Eric H. Halvorson, have been determined by the board to be independent under the NASDAQ Rules. Mr. Halvorson formerly served with the company in several capacities, including as its Chief Operating Officer for five years and its General Counsel for 12 years. He resigned from the company in 2000, but continued to render legal services to the company thereafter pursuant to an independent contractor agreement. Mr. Halvorson ceased providing such services to the company in 2002.

Mr. Halvorson could not be determined by the board to be “independent” because, in 2002, he received more than $60,000 in total compensation from the company in connection with consulting services provided by

6

Mr. Halvorson under the independent contractor agreement. This consulting arrangement was terminated in 2002 and Mr. Halvorson did not perform any consulting services for the company in 2003. The company believes that Mr. Halvorson will be eligible to be determined by the board as “independent” under the NASDAQ Rules in January 2006.

The company’s board of directors initially determined that the addition of Mr. Halvorson to the Audit Committee as of November 15, 2001, was required in the best interests of the company and its stockholders because of his extensive industry and professional expertise. In March 2004, the board of directors determined that the continued membership of Mr. Halvorson on the Audit Committee remains in the best interests of the company and complies with applicable NASDAQ Rules permitting the appointment of one non-independent director to the Audit Committee in exceptional and limited circumstances.

The Compensation Committee currently consists of Messrs. Hinz (Chairman), Davenport and Riddle. The Compensation Committee is authorized to review and approve compensation, including non-cash benefits, and severance arrangements for the company’s senior officers and employees and to recommend to the board salaries, remuneration and other forms of additional compensation and benefits as it deems necessary. The Compensation Committee also administers the company’s 1999 Stock Incentive Plan. The Compensation Committee Report set forth later in this Proxy Statement provides additional details concerning the committee’s determination of compensation for the company’s senior management.

The Compensation Committee held four meetings in 2003. The Compensation Committee meets at least twice annually and at additional times as are necessary or advisable to fulfill all of its duties and responsibilities.

Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee currently consists of Messrs. Pressler (Chairman), Davenport, Hinz, Hodel and Riddle, each of whom is independent under the NASDAQ Rules. This committee was established as a standing committee by the board in March 2004 and, to date, has not yet held a formal meeting. The board has directed this committee to meet at least twice annually and at additional times as are necessary or advisable to fulfill all of its duties and responsibilities.

The board of directors has adopted a written charter for the Nominating and Corporate Governance Committee. This charter is available on Salem’s Internet website (www.salem.cc) and a copy of the charter may be obtained upon written request from the Secretary of the company. Any information found on the company’s website is not a part of, or incorporated by reference into, this or any other report of the company filed with, or furnished to, the SEC.

The Nominating and Corporate Governance Committee is authorized to: (i) develop and recommend a set of corporate governance standards to the board of directors for adoption and implementation, (ii) identify individuals qualified to become members of the board of directors, (iii) recommend that director nominees be elected at the company’s next annual meeting of stockholders, (iv) recommend nominees to serve on each standing committee of the board of directors, (v) lead in the annual review of board performance and evaluation of the board’s effectiveness, (vi) ensure that succession planning takes place for the position of Chief Executive Officer and other key company senior management positions, and (vii) analyze, review and, where appropriate, approve all related party transactions to which the company or its subsidiaries or affiliates are a party, all in accordance with applicable rules and regulations.

To qualify as a nominee for service on the board of directors, a candidate must have sufficient time and resources available to successfully carry out the duties required of a Salem board member. The committee desires to attract and retain highly qualified directors who will diligently execute their responsibilities and enhance their knowledge of the company’s core businesses.

7

The Nominating and Corporate Governance Committee implements Salem’s policy regarding shareholder nominations by considering nominees for director positions that are made by the company’s stockholders. Any stockholder desiring to make such a nomination must submit in writing the name(s) of the recommended nominees to the Secretary of the company at least 90 days before the annual meeting of stockholders. The written submission must also contain biographical information about the proposed nominee, a description of the nominee’s qualifications to serve as a member of the board of directors, and evidence of the nominee’s valid consent to serve as a director of the company if nominated and duly elected.

The company’s directors provide oversight of Salem’s management and play a key role in shaping the strategic direction of the company. Consistent with the Company’s Nominating and Corporate Governance Charter, the Committee considers various criteria in Board candidates, including, among others, independence, character, judgment and business experience, as well as their appreciation of the Company’s core purpose, core values, and whether they have time available to devote to Board activities. The Committee also considers whether a potential nominee would satisfy:

| 1. | NASDAQ’s criteria of director “independence”; and |

| 2. | The SEC’s definition of “audit committee financial expert”. |

Whenever a vacancy exists on the Board due to expansion of the Board’s size or the resignation or retirement of an existing director, the Committee will identify and evaluate potential director nominees. The Committee considers recommendations of management, stockholders and others. The Committee has sole authority to retain and terminate any search firm to be used to identify director candidates, including approving its fees and other retention terms.

Director candidates are evaluated using the criteria described above and in light of the then-existing composition of the Board, including its overall size, structure, backgrounds and areas of expertise of existing directors and the relative mix of independent and management directors. The Committee also considers the specific needs of the various Board committees. The Committee recommends potential director nominees to the full Board, and final approval of a candidate for nomination is determined by the full Board. This evaluation process is the same for director nominees who are recommended by our stockholders.

The Committee did not receive any recommendations from stockholders proposing candidate(s) for election at the 2004 Annual Meeting. None of the directors serving on the Audit Committee, the Compensation Committee, or the Nominating and Corporate Governance Committee are employees of the company.

Board Meetings and Director Attendance at 2003 Annual Stockholder’s Meeting

The full board of directors held five meetings in 2003. During 2003, each of the company’s incumbent directors attended all of the meetings of the full board of directors and all meetings of the committees of the board of directors on which they served. The company encourages, but does not require, that each director attend the annual meeting of stockholders. In 2003, each of the company’s incumbent directors except Mr. Riddle attended the annual meeting of stockholders.

Directors’ Fees. Officers of Salem who also serve as directors do not receive compensation for their services as directors, other than the compensation they receive as officers of Salem. In 2003, directors of Salem who are not also officers or employees of Salem received $5,000 for attending each regular or special meeting of the board of directors and $1,000 for attending each regular or special meeting of any committee of the board of directors. Directors of Salem are entitled to reimbursement of their reasonable out-of-pocket expenses in connection with their travel to and attendance at board and committee meetings.

8

Stock Option Grants. In return for their service, directors of Salem who are not also officers or employees of Salem were each granted options to purchase 2,500 shares of Salem’s Class A common stock on September 11, 2003. All of these options vest after one year.

Employment and Consulting Agreements. Messrs. Atsinger and Epperson are employed as officers of Salem pursuant to Employment Agreements. Mr. Halvorson was employed by Salem as a consultant pursuant to a Consulting Agreement that was terminated in 2002. For more information regarding the Employment Agreements, see “EXECUTIVE COMPENSATION AND OTHER INFORMATION—Employment Agreements.” For more information regarding the Consulting Agreement, see “RELATED PARTY TRANSACTIONS—Agreement with Mr. Halvorson.”

Communications Between Stockholders and the Board

The company has historically handled communications between stockholders and the board of directors on an ad hoc basis. No formal policy or process for such communications has been adopted by the company as of the date of this Proxy Statement. The company has, however, taken actions to ensure that the views of its stockholders are communicated to the board or one or more of its individual directors, as applicable. The board considers its responsiveness to such communications as timely and exemplary. In order to comply with best practices in this area, however, the Nominating and Corporate Governance Committee will, at a future meeting, give consideration to the adoption of a formal, written process addressing stockholder communications to the board. If such a process is adopted by this committee, it will be made available on the company’s Internet website (www.salem.cc) as soon as reasonably possible thereafter.

The company has adopted a Financial Code of Conduct that applies to each director and employee of Salem (including without limitation the company’s Chief Executive Officer, Chief Financial Officer and Controller). This Financial Code of Conduct has been adopted by the board as a “code of ethics” that satisfies applicable SEC requirements and NASDAQ Rules. The Financial Code of Conduct is available on Salem’s Internet website (www.salem.cc) and a copy of the code may be obtained upon written request from the Secretary of the company.

Set forth below are the executive officers of the company, together with the positions held by those persons as of March 31, 2004. The executive officers are elected annually and serve at the pleasure of the company’s board of directors; however, the company has entered into Employment Agreements with Messrs. Atsinger, Epperson and Evans, which agreements are described under the section of this Proxy Statement entitled “EXECUTIVE COMPENSATION AND OTHER INFORMATION—EMPLOYMENT AGREEMENTS” below.

| Name of Executive Officer |

Age |

Position Held with the Company | ||

| Stuart W. Epperson |

67 | Chairman of the Board | ||

| Edward G. Atsinger III |

64 | President, Chief Executive Officer and Director | ||

| Joe D. Davis |

60 | Executive Vice President of Radio | ||

| David A.R. Evans |

41 | Executive Vice President and Chief Financial Officer | ||

| Greg R. Anderson |

57 | President of Salem Radio Network® | ||

| James R. Cumbee |

51 | President of Non-Broadcast Media | ||

| Jonathan L. Block |

37 | Vice President, General Counsel and Secretary | ||

| Evan D. Masyr |

32 | Vice President of Accounting and Corporate Controller |

9

Set forth below is certain information concerning the business experience during the past five years and other relevant experience of each of the individuals named above (excluding Messrs. Atsinger and Epperson, whose business experience is described in the above section of this Proxy Statement entitled “THE BOARD OF DIRECTORS”).

Mr. Davis has been Salem’s Executive Vice President of Radio since 2003. Prior to that time, Mr. Davis was Executive Vice President, Operations since 2001, Senior Vice President of Salem since 2000, Vice President, Operations of Salem since 1996 and General Manager of WMCA-AM since 1989. He was also the General Manager of WWDJ-AM since 1994. He has previously served as Vice President and Executive Director of the Christian Fund for the Disabled as well as President of Practice Resources, Inc., Davis Eaton Corporation and Vintage Specialty Advertising Company.

Mr. Evans has been Executive Vice President and Chief Financial Officer of Salem since September 2003. From 2000 to 2003, Mr. Evans served as the company’s Senior Vice President and Chief Financial Officer. From 1997 to 2000, Mr. Evans served as Senior Vice President and Managing Director—Europe, Middle East, and Africa of Warner Bros. Consumer Products in London, England. He also served at Warner Bros. Consumer Products in Los Angeles, California, as Senior Vice President—Latin America, International Marketing, Business Development from 1996 to 1997 and Vice President—Worldwide Finance, Operations, and Business Development from 1992 to 1996. From 1990 to 1992, he served as Regional Financial Controller—Europe of Warner Bros. Consumer Products in London, England. Prior to 1990, Mr. Evans was an audit manager with Ernst & Young LLP in Los Angeles, California and worked as a U.K. Chartered Accountant for Ernst & Young LLP in London, England.

Mr. Anderson has been President of Salem Radio Network® since 1996. From 1993 to 1994, Mr. Anderson was the Vice President-General Manager of this network. Mr. Anderson was employed by Multimedia, Inc. from 1980 to 1993. After serving as General Manager at Multimedia stations in Greenville, South Carolina, Shreveport, Louisiana and Milwaukee, Wisconsin, he was named Vice President, Operations, of the Multimedia radio division in 1987 and was subsequently appointed as Executive Vice President and group head of Multimedia’s radio division.

Mr. Cumbee has been the President of Non-Broadcast Media of Salem since January 2000. He was the President of Reach Satellite Network, Inc. in Nashville, Tennessee from 1996 through 1999. Salem purchased all of the shares of stock of Reach Satellite Network, Inc. in March 2000. From 1994 to 1996, he served as Vice President of Disney Vacation Development Company.

Mr. Block has been General Counsel of Salem since May 2000, Vice President since 1999 and Corporate Secretary since 1997. Since August 2000, Mr. Block has been a director of each subsidiary of Salem other than Salem Communications Holding Corporation. From 1995 to 2000, Mr. Block served as Associate General Counsel of Salem.

Mr. Masyr has been Vice President of Accounting and Corporate Controller since January 2003. From February 2000 to December 2002, he served as Controller. From 1993 to February 2000, Mr. Masyr worked for PricewaterhouseCoopers LLP (formerly, Coopers & Lybrand LLP). Mr. Masyr has been a Certified Public Accountant since 1995.

10

EXECUTIVE COMPENSATION AND OTHER INFORMATION

The following table sets forth all compensation paid by the company for 2003, 2002 and 2001 to the company’s Chief Executive Officer and the four highest paid executive officers of the company serving as of December 31, 2003 (the “Named Executive Officers”).

| Year |

Annual Compensation |

All Other | |||||||||

| Name and Principal Positions |

Salary |

Bonus |

Other Annual Compensation |

||||||||

| Edward G. Atsinger III President, Chief Executive Officer and Director |

2003 2002 2001 |

700,000 700,000 513,750 |

— — 300,000 |

(2) |

— — — |

44,016(1) 41,184(1) 35,037(1) | |||||

| Stuart W. Epperson Chairman of the Board |

2003 2002 2001 |

600,000 600,000 513,750 |

— — 200,000 |

(4) |

— — — |

37,739(3) 34,904(3) 28,762(3) | |||||

| Joe D. Davis Executive Vice President of Radio |

2003 2002 2001 |

329,215 285,000 251,600 |

— 32,000 40,000 |

|

— — — |

3,500(5) 2,700(5) 2,625(5) | |||||

| David A.R. Evans Executive Vice President and |

2003 2002 2001 |

318,548 277,632 258,796 |

20,000 47,500 — |

|

— — — |

3,000(5) 2,750(5) 2,625(5) | |||||

| Robert C. Adair(6) Senior Vice President, Operations |

2003 2002 2001 |

308,700 280,000 264,804 |

— 35,000 — |

|

— — |

3,100(5) 2,938(5) 2,625(5) | |||||

| (1) | Represents imputed income in connection with amounts paid by Salem for split-dollar life insurance covering the lives of Mr. Atsinger and his spouse, such policy owned by Salem as of December 31, 2003. See “RELATED PARTY TRANSACTIONS—Split-Dollar Life Insurance” for further information. For each year, such imputed income represents the interest-free use of the aggregate periodic contributions made by Salem towards premium payments under the split-dollar life insurance arrangements. Salem contributed $66,966, $112,860 and $102,400 in 2003, 2002 and 2001, respectively, towards such premium payments. |

| (2) | On July 1, 2001, Mr. Atsinger received a signing bonus of $300,000. See “EXECUTIVE COMPENSATION AND OTHER MATTERS—Employment Agreements” below for further information. |

| (3) | Represents imputed income in connection with amounts paid by Salem for split-dollar life insurance covering the lives of Mr. Epperson and his spouse, such policy owned by Salem as of December 31, 2003. See “RELATED PARTY TRANSACTIONS—Split-Dollar Life Insurance” for further information. For each year, such imputed income represents the interest-free use of the aggregate periodic contributions made by Salem towards premium payments under the split-dollar life insurance arrangements. Salem contributed $66,966, $113,060 and $101,400 in 2003, 2002 and 2001, respectively, towards such premium payments. |

| (4) | On July 1, 2001, Mr. Epperson received a signing bonus of $200,000. See “EXECUTIVE COMPENSATION AND OTHER MATTERS—Employment Agreements” below for further information. |

| (5) | Represents employer matching contributions to individuals’ 401(k) accounts. |

| (6) | Mr. Adair is a Named Executive Officer based upon compensation received during 2003. He is not, however, designated as an executive officer pursuant to Section 16 of the Exchange Act and the regulations promulgated thereunder because he does not perform a policy making function. |

11

The following table sets forth information regarding grants of stock options under the 1999 Stock Incentive Plan by the company during 2003 to the Named Executive Officers.

| Initial Grants |

Potential Realizable Value of Assumed Annual Rates of Stock Price Appreciation for Option Term | |||||||||||||||

| Name |

Number of Shares of Class A Common Stock Underlying Options Granted(#) |

Percent of Total Options Granted to Employees in Fiscal Year |

Exercise or Base Price ($/SH) |

Expiration Date |

5%($) |

10%($) | ||||||||||

| Edward G. Atsinger III |

— | 0.0 | % | $ | $ | — | $ | — | ||||||||

| Stuart W. Epperson |

— | 0.0 | % | — | — | |||||||||||

| Joe D. Davis |

— | 0.0 | % | — | — | |||||||||||

| David A.R. Evans |

6,800 | 3.0 | % | 16.20 | 03/24/2008 | 30,435 | 67,254 | |||||||||

| 12,500 | 5.6 | % | 23.35 | 09/11/2009 | 99,265 | 225,199 | ||||||||||

| 12,500 | 5.6 | % | 23.35 | 09/11/2010 | 118,822 | 276,907 | ||||||||||

| 12,500 | 5.6 | % | 23.35 | 09/11/2011 | 139,357 | 333,785 | ||||||||||

| 12,500 | 5.6 | % | 23.35 | 09/11/2012 | 160,919 | 396,351 | ||||||||||

| 12,500 | 5.6 | % | 30.00 | 09/11/2013 | 100,434 | 382,049 | ||||||||||

| 12,500 | 5.6 | % | 30.00 | 09/11/2014 | 124,205 | 457,753 | ||||||||||

| 12,500 | 5.6 | % | 30.00 | 09/11/2015 | 149,166 | 541,029 | ||||||||||

| 12,500 | 5.6 | % | 30.00 | 09/11/2016 | 175,374 | 632,632 | ||||||||||

| Robert C. Adair |

6,800 | 3.0 | % | 16.20 | 03/24/2008 | 30,435 | 67,254 | |||||||||

Securities Authorized for Issuance Under Equity Compensation Plans

The following table provides information as of December 31, 2003, in respect of shares of our Class A common stock that may be issued under the 1999 Stock Incentive Plan, our only existing equity compensation plan. The 1999 Stock Incentive Plan was adopted by our board of directors and approved by our stockholders on May 25, 1999. On March 22, 2004, the company registered an additional 600,000 shares of the company’s Class A common stock for issuance under the plan by filing a Form S-8 registration statement with the SEC pursuant to a March 2003 board approval of an amendment to the 1999 Stock Incentive Plan to reserve such additional shares. This amendment was subsequently approved by a vote of the stockholders at the company’s 2003 annual meeting of stockholders held on June 11, 2003.

| Equity Compensation Plan Information | ||||||

| Plan Category |

Number of Securities to be Issued Upon Exercise of Outstanding Options, Warrants and Rights |

Weighted-Average Exercise Price of Outstanding Options, |

Number of Securities Remaining Available for Future Issuance Under Equity Compensation Plans (Excluding Securities Reflected in Column (a)) | |||

| (a) | (b) | (c) | ||||

| Equity compensation plans approved by security holders |

745,915 | 20.54 | 799,910 | |||

| Equity compensation plans not approved by security holders |

— | — | — | |||

| Total: |

745,915 | 20.54 | 799,910 | |||

12

Edward G. Atsinger III and Stuart W. Epperson entered into separate Employment Agreements with Salem effective as of July 1, 2001, pursuant to which Mr. Atsinger serves as President and Chief Executive Officer of Salem and Mr. Epperson serves as Chairman of Salem. The initial employment term under each agreement expires June 30, 2004. The Compensation Committee has begun discussions with Mssrs. Atsinger and Epperson concerning an extension of these Employment Agreements and the company anticipates that extensions of the agreements will be completed before their stated expiration date. If formal extensions are not completed before June 30, 2004, and unless notice is provided to the contrary, each Employment Agreement renews automatically for successive one-year periods thereafter.

Pursuant to the employment agreements, each of Messrs. Atsinger and Epperson will be paid an annual base salary as specified in their respective agreements and an annual bonus determined at the discretion of the board of directors. In addition, on July 1, 2001, Messrs. Atsinger and Epperson received signing bonuses of $300,000 and $200,000, respectively, pursuant to their respective Employment Agreements. Each executive is required to repay a pro rata portion of the signing bonus if his employment is terminated at any time during the initial three-year term of his employment agreement. As of December 31, 2003, the unearned portion of these signing bonuses was $50,000 for Mr. Atsinger and $33,333 for Mr. Epperson.

Effective as of January 1, 2003, the annual base salary payable under their respective Employment Agreements is $700,000 for Mr. Atsinger and $600,000 for Mr. Epperson. The Employment Agreements each provide that, in the event of a termination of employment by Salem without cause (or a constructive termination by Salem) during the initial term of employment, Salem will pay a severance benefit in the form of salary continuation payments for the longer of six months or the remainder of the initial term, plus accrued bonus through the date of termination. Following the initial term of employment, a termination of employment by Salem without cause (or a constructive termination by Salem) or a failure by Salem to renew the initial or any subsequent term of employment for an additional annual term would entitle Messrs. Atsinger and Epperson to three months of severance plus accrued bonus through the date of termination.

Additionally, the Employment Agreements with Messrs. Atsinger and Epperson provide Salem with a right of first refusal on corporate opportunities, which includes acquisitions of radio stations in any market in which Salem is interested, and include a nondisclosure provision which is effective for the term of the Employment Agreements and indefinitely thereafter.

David A.R. Evans entered into an employment agreement with Salem pursuant to which he serves as Executive Vice President and Chief Financial Officer of Salem. Effective as of September 16, 2003, his annual salary is $310,000 and, effective as of September 16, 2004, his annual salary will increase to $330,000. Effective as of September 16, 2005, his annual salary will increase to $350,000. Mr. Evans’ employment agreement expires on September 15, 2006.

The company adopted a 401(k) savings plan in 1993 for the purpose of providing, at the option of the employee, retirement benefits to full-time employees of the company and its subsidiaries. Participants are allowed to make non-forfeitable contributions to the savings plan of up to 15% of their annual salary, but may not exceed the annual maximum contribution limitations established by the Internal Revenue Service. The company currently matches 50% on the first 3% of the amounts contributed by each participant and 25% of the next 3% contributed but does not match participants’ contributions in excess of 6% of their compensation per pay period. Prior to January 1, 2004, the company matched 25% of the amounts contributed by each participant but did not match participants’ contributions in excess of 6% of their compensation per pay-period. The company made a contribution of $511,000 to the 401(k) savings plan during 2003.

13

Compensation Committee Interlocks and Insider Participation

The company’s Compensation Committee consists of Messrs. Hinz (Chairman), Davenport and Riddle. No member is, or formerly was, an officer or employee of the company or any of its subsidiaries and none had any relationship with the company requiring disclosure herein under applicable rules. In addition, to the company’s knowledge, no executive officer or director of Salem has served as a director or a member of the compensation committee of another entity that requires disclosure herein under applicable rules.

The Audit Committee reviews the company’s financial reporting process on behalf of the board of directors. Management has the primary responsibility for the financial statements and the financial reporting process. The company’s independent auditors are responsible for performing an independent audit of the company’s consolidated financial statements in accordance with generally accepted auditing standards and for expressing an opinion on the conformity of the audited financial statements to generally accepted accounting principles. The Audit Committee’s responsibility is to monitor and oversee these processes.

In connection with these responsibilities, the Audit Committee met with management and the independent auditors to review and discuss the audited December 31, 2003 financial statements. The Audit Committee also discussed with the independent auditors the matters required by the Statement on Auditing Standards No. 61 (Communication with Audit Committees). The Audit Committee also received written disclosures and the letter from the independent auditors required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees), and the Audit Committee discussed with the independent auditors that firm’s independence from the company and its management. The Audit Committee has also considered whether the independent auditors’ provision of non-audit services to the company is compatible with the auditors’ independence.

Based upon the Audit Committee’s discussions with management and the independent auditors, and the Audit Committee’s review of the representations of management and the independent auditors, the Audit Committee recommended that the board of directors include the audited consolidated financial statements in the company’s Annual Report on Form 10-K for the year ended December 31, 2003, to be filed with the Securities and Exchange Commission.

AUDIT COMMITTEE

Richard A. Riddle (Chairman)

Eric H. Halvorson

Donald P. Hodel

The preceding “Audit Committee Report” shall not be deemed soliciting material or to be filed with the SEC, nor shall any information in this report be incorporated by reference into any past or future filing under the Acts, except to the extent that the company specifically incorporates it by reference into such filing.

The company’s compensation program is administered by the Compensation Committee, which is comprised of three outside, non-employee directors. Following review and approval by the Compensation Committee, issues pertaining to compensation benefits and severance arrangements for the company’s executive officers and other key employees are submitted to the full board of directors for approval.

The following is the Compensation Committee Report addressing the compensation of the company’s executive officers and other key employees for the 2003 fiscal year.

14

COMPENSATION COMMITTEE REPORT ON EXECUTIVE COMPENSATION

The company’s compensation program is administered by the Compensation Committee, which is comprised of three “independent directors” as determined by the board of directors applying the relevant SEC and NASDAQ Rules. Following review and approval by the Compensation Committee, issues pertaining to compensation benefits and severance arrangements for the company’s executive officers and other key employees are submitted to the full board of directors for approval.

The following is the Compensation Committee Report addressing the compensation of the company’s executive officers and other key employees for the 2003 fiscal year.

Report of the Compensation Committee

The primary function of the Compensation Committee is to oversee Salem’s policies relating to executive compensation. The Compensation Committee’s primary objectives are to attract and retain qualified individuals by providing competitive compensation and to encourage key management employees to conduct the affairs of the company in a manner that will directly benefit the company and its stockholders.

The Compensation Committee’s policy is to establish fair and competitive base salaries for the company’s executive officers and other key employees. In fulfilling this role, the Compensation Committee compares the salaries of Salem’s executive officers and other key employees with the salaries of individuals with similar responsibilities at companies that are considered to be comparable to Salem in terms of assets, market capitalization, revenue and operating cash flow. The Compensation Committee also analyzes the impact of an executive officer’s or other key employee’s individual performance with respect to matters important to the interests of Salem and believes that outstanding performance merits increases in base salary, bonus consideration and stock-based incentives. The Compensation Committee believes that a direct relationship between an executive officer’s or other key employee’s compensation and that individual’s contribution to the company’s interests best serves the company’s stockholders.

Accordingly, the following principles are inherent in all of the Compensation Committee’s considerations regarding compensation for executive officers and other key employees:

| 1. | In order to attract and retain highly qualified and experienced personnel necessary to fulfill the objectives of the company, Salem must offer competitive compensation, including a competitive base salary, cash bonus incentives and stock-based incentives; |

| 2. | Cash compensation in excess of the employee’s base salary should be tied to the individual’s performance, the performance of the business unit for which the employee is responsible and the overall performance of the company; and |

| 3. | The financial interests of the executive officers and key employees of the company should be closely aligned with the financial interests of the company’s stockholders. |

In 2003, the two primary forms of compensation paid or awarded to Salem’s executive officers and key employees were salary and stock options. The base salaries for the Chairman and Chief Executive Officer in 2003 were provided for in their respective Employment Agreements with Salem. The Chairman’s base salary for 2003 was $600,000. The Chief Executive Officer’s base salary for 2003 was $700,000. Salary for all other executive officers and key employees is reviewed periodically and adjusted as warranted in accordance with the company’s principles regarding executive compensation outlined above.

In 2001, the Compensation Committee renewed the Employment Agreements with the Chairman and Chief Executive Officer following the principles set forth above. Effective January 1, 2002, through June 30, 2004, the annual compensation of the Chairman was set at $600,000 and the annual compensation of the Chief Executive Officer was set at $700,000.

15

In addition, the Chairman and Chief Executive Officer were paid signing bonuses of $200,000 and $300,000, respectively, upon the signing of their Employment Agreements. The signing bonuses are refundable to the company on a pro rata basis should the Chairman or Chief Executive Officer terminate their employment prior to July 2004.

All additional cash compensation paid to executive officers (other than our Chairman and Chief Executive Officer) and other key employees in 2003 was tied to the performance of the individual, the business unit for which they were responsible and the company. Bonuses to the company’s Chairman and Chief Executive Officer are determined by the Compensation Committee and are based, in part, upon the performance of the company as well as the individual performance of these officers.

In 2003, no cash bonuses were paid to Salem’s executive officers and other key employees for company performance during 2002. Our Chief Executive Officer was paid a cash bonus of $257,558 in March 2004 that, while paid in 2004, rewarded his performance in 2003. Our Chairman was paid a cash bonus of $185,442 in March 2004 that, while paid in 2004, rewarded his performance in 2003.

The Compensation Committee believes that ownership of the company’s stock by key management more closely aligns the interests of key members of management to that of stockholders. In 2003, to further provide incentives to key employees, stock options were granted to certain key members of management as more specifically described in the section of this Proxy Statement entitled “Stock Option Grants.” In addition to the 2003 option grants, in March 2004, the company granted options for the purchase of Class A common stock as compensation for management’s performance during 2003 as follows: Edward G. Atsinger, III, 24,850 options, Stuart Epperson, 17,892 options, Joe D. Davis, 1,025 options, and David A.R. Evans, 359 options. These options have an exercise price equal to or exceeding the fair market price of the Class A common stock on the date of the grant and vest immediately.

The majority of the remaining stock options granted to executive officers and other key employees in 2003 vest over four years and have an exercise price per share equal to or exceeding the fair market price of the Class A common stock at the time that the stock option was granted. This approach is designed to increase stockholder value over a long term, since the full benefit of the compensation package cannot be realized unless the stock price appreciation occurs over a number of years.

The Internal Revenue Code (“IRC”) contains a provision that limits the tax deductibility of certain compensation paid to certain executive officers and disallows the deductibility of certain compensation in excess of $1,000,000 per year unless the compensation is considered “performance-based” pursuant to the rules established in the IRC. Salem’s policies and practices generally ensure the maximum deduction possible under the IRC; however, the company reserves the right to forego any and all of the tax deduction if it is believed to be in the best overall interest of Salem and its stockholders.

COMPENSATION COMMITTEE

Roland S. Hinz (Chairman)

David Davenport

Richard A. Riddle

The preceding “Compensation Committee Report on Executive Compensation” addresses the company’s practices for fiscal year 2003 as they affected the company’s Chief Executive Officer and its other executive officers, including the Named Executive Officers in this Proxy Statement. This report shall not be deemed soliciting material or to be filed with the SEC, nor shall any information in this report be incorporated by reference into any past or future filing under the Securities Act or the Exchange Act, except to the extent the company specifically incorporates it by reference into such filing.

16

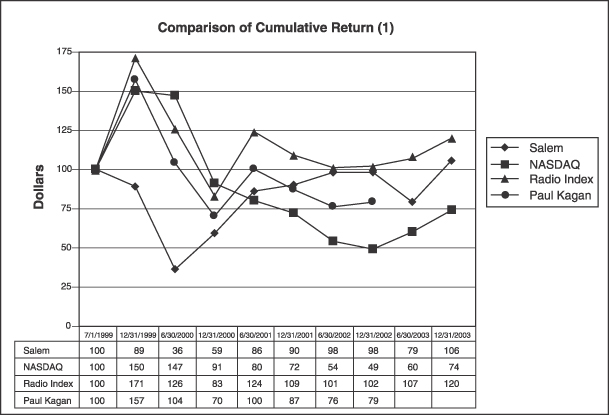

The graph below compares the cumulative total stockholder return of the company’s Class A common stock with the cumulative total return of the NASDAQ—NMS equity index and the Bloomberg Broadcast and Cable Radio Index since July 1, 1999, when the company’s Class A common stock was first registered under the Exchange Act, through December 31, 2003. The company’s Class B common stock is not publicly traded and is not registered. The graph assumes that the value of an investment in the company’s Class A common stock and each index was $100 on July 1, 1999, and that any dividends were reinvested. No cash dividends have been declared on the company’s Class A common stock since the initial public offering. Stockholder returns over the indicated period should not be considered indicative of future stockholder returns.

| (1) | Salem’s Class A common stock returns were calculated based on the closing sales prices per share of the Class A common stock as follows: 7/1/99 (initial trading day), $25.50; 12/31/99, $22.63; 6/30/00, $9.28; 12/31/00, $14.94; 6/30/01, $21.88; 12/31/01, $23.00; 6/30/02, $24.87; 12/31/02, $24.97; 6/30/03, $20.23; 12/31/03, $27.12. The $22.50 per share initial public offering price of the company’s Class A common stock was not used in calculating the Salem graph points. |

For purposes of this Proxy Statement, and until otherwise noted in the company’s subsequent Proxy Statements, the company is using the Bloomberg Broadcast and Cable Radio Index as its comparative index for purposes of the stock price performance graph above. The reason for this change from the prior year’s Proxy Statement is that the Paul Kagan Associates, Inc. Radio Station Average Index is no longer published.

The stock price performance graph above shall not be deemed incorporated by reference by any general statement incorporating by reference this Proxy Statement into any filing under the Securities Act or the Exchange Act and shall not otherwise be deemed filed or furnished under such Acts, except to the extent that the company specifically incorporates this information by reference.

17

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth information regarding the beneficial ownership of the company’s Class A common stock and Class B common stock as of March 31, 2004, by (i) each person believed by the company to be the beneficial owner of more than 5% of either class of the outstanding Class A common stock or Class B common stock, (ii) each director, (iii) each of the Named Executive Officers, and (iv) all directors and executive officers as a group. All information with respect to beneficial ownership is based on filings made by the respective beneficial owners with the SEC or information provided to the company by the beneficial owners.

| Class A Common Stock |

Class B Common Stock |

Percent of Votes of Common |

|||||||||||||

| Name and Address(1) |

Number |

% Vote(2) |

Number |

% Vote(2) |

|||||||||||

| Stuart W. Epperson |

4,336,533 | (3) | 24.12 | % | 2,776,848 | (4) | 50.00 | % | 43.67 | % | |||||

| Nancy A. Epperson |

3,080,621 | (3) | 17.13 | % | 2,776,848 | (4) | 50.00 | % | 41.96 | % | |||||

| Edward G. Atsinger III |

4,585,380 | (5) | 25.50 | % | 2,776,848 | (5) | 50.00 | % | 44.01 | % | |||||

| Edward C. Atsinger |

1,178,078 | (6) | 6.55 | % | — | — | 1.60 | % | |||||||

| Robert C. Adair |

22,800 | (7) | * | — | — | * | |||||||||

| David Davenport |

4,550 | (8) | * | — | — | * | |||||||||

| Joe D. Davis |

19,525 | (9) | * | — | — | * | |||||||||

| David A.R. Evans |

38,234 | (10) | * | — | — | * | |||||||||

| Eric H. Halvorson |

16,500 | (11) | * | — | — | * | |||||||||

| Roland S. Hinz |

108,527 | (12) | * | — | — | * | |||||||||

| Donald P. Hodel |

9,000 | (13) | * | — | — | * | |||||||||

| Judge Paul Pressler |

2,500 | (14) | * | — | — | * | |||||||||

| Richard A. Riddle |

64,667 | (15) | * | — | — | * | |||||||||

| FMR Corp. |

1,253,659 | (16) | 6.97 | % | — | — | 1.71 | % | |||||||

| 82 Devonshire Street Boston, MA 02109 |

|||||||||||||||

| Westport Asset Management |

1,302,725 | (17) | 7.25 | % | — | — | 1.77 | % | |||||||

| 253 Riverside Ave. Westport, CT 06880 |

|||||||||||||||

| Columbia Wanger Asset Management, L.P. 227 West Monroe St., Suite 3000 Chicago, IL 60606 |

1,902,600 | (18) | 10.58 | % | — | — | 2.59 | % | |||||||

| All directors and executive officers as a |

9,250,061 | 51.45 | % | 5,553,696 | 100 | % | 88.13 | % | |||||||

| * | Less than 1%. |

| (1) | Except as otherwise indicated, the address for each person is c/o Salem Communications Corporation, 4880 Santa Rosa Road, Camarillo, California 93012. Calculated pursuant to Rule 13d-3(d)(1) under the Exchange Act, shares of Class A common stock not outstanding that are subject to options exercisable by the holder thereof within 60 days of March 31, 2004, are deemed outstanding for the purposes of calculating the number and percentage ownership by such stockholder, but not deemed outstanding for the purpose of calculating the percentage owned by each other stockholder listed. Unless otherwise noted, all shares listed as beneficially owned by a stockholder are actually outstanding. |

| (2) | Percentage voting power is based upon 17,979,592 shares of Class A common stock and 5,553,696 shares of Class B common stock all of which were outstanding as of March 31, 2004, and the general voting power of one vote for each share of Class A common stock and ten votes for each share of Class B common stock. |

| (3) | Includes shares of Class A common stock held by a trust of which Mr. Epperson is trustee and shares held directly by Mr. Epperson. As husband and wife, Mr. and Mrs. Epperson are each deemed to be the beneficial owner of shares held by the other and, therefore, their combined beneficial ownership is shown in |

18

| the table. Includes 28,392 shares of Class A common stock subject to options that are exercisable within 60 days. |

| (4) | Includes shares of Class B common stock held by a trust of which Mr. and Mrs. Epperson are trustees. |

| (5) | These shares of Class A common stock and Class B common stock are held by trusts of which Mr. Atsinger is trustee. Includes 39,850 shares of Class A common stock subject to options that are exercisable within 60 days. |

| (6) | Includes 1,175,078 shares of Class A common stock held in a trust for the benefit of Edward C. Atsinger, who is Edward G. Atsinger III’s son. Edward G. Atsinger III is the trustee of the trust and these shares are included in the shares beneficially owned by Edward G. Atsinger III as reflected in this table. Also includes 3,000 shares of Class A common stock held by Edward C. Atsinger, individually, which shares are not included in the shares beneficially owned by Edward G. Atsinger III as reflected in this table. |

| (7) | Includes 22,800 shares of Class A common stock subject to options that are exercisable within 60 days. |

| (8) | Includes 4,550 shares of Class A common stock subject to options that are exercisable within 60 days. |

| (9) | Includes 16,025 shares of Class A common stock subject to options that are exercisable within 60 days. |

| (10) | Includes 2,450 shares of Class A common stock held by a trust for which Mr. Evans is trustee, 600 shares held in custody his minor daughter and 2,750 shares held by Mr. Evan’s spouse as a joint tenant with Mr. Evans’ father-in-law. Mr. Evans disclaims beneficial ownership of all of the 2,750 shares of Class A common stock beneficially owned by his spouse. Includes 32,434 shares of Class A common stock subject to options that are exercisable within 60 days. |

| 11) | These shares of Class A common stock are held by trusts for which Mr. Halvorson and his wife are trustees. Includes 14,000 shares of Class A common stock subject to options that are exercisable within 60 days. |

| (12) | Includes 1,411 shares held by his wife and 444 shares held by his son. Mr. Hinz disclaims beneficial ownership of shares of Class A common stock held by his wife and his son. Includes 11,000 shares of Class A common stock subject to options that are exercisable within 60 days. |

| (13) | Includes 9,000 shares of Class A common stock subject to options that are exercisable within 60 days. |

| (14) | Includes 2,500 shares of Class A common stock subject to options that are exercisable within 60 days. |

| (15) | Includes 44,778 shares of Class A common stock held by a trust for which Mr. Riddle is trustee. Includes 11,000 shares of Class A common stock subject to options that are exercisable within 60 days. |

| (16) | This information is based on a Schedule 13G filed by FMR Corp. (“FMRC”), Edward C. Johnson 3d (“ECJ”), Abigail P. Johnson (“APJ” and, together with ECJ and FMRC, “FMR”), with the SEC on February 17, 2004. FMR reported that as of such date it was the beneficial owner of 1,253,659 shares of our issued and outstanding Class A common stock. FMR reported that it has sole voting power with respect to 311,504 shares and sole dispositive power with respect to 1,253,659 shares. |

| (17) | This information is based on a Schedule 13G/A filed by Westport Asset Management, Inc. (and certain affiliates hereafter described) with the SEC on February 13, 2004. Westport Asset Management, Inc. reported that as of such date it was the beneficial owner of 1,302,725 shares of our issued and outstanding Class A common stock which were acquired on behalf of Westport Asset Management, Inc.’s discretionary clients, including Westport Advisors, LLC. Westport Asset Management, Inc. reported that it has sole voting power with respect to 596,925 shares, shared voting power with respect to 560,800 shares, sole dispositive power with respect to 596,925 shares and shared dispositive power with respect to 705,800 shares. |

| (18) | This information is based on the Schedule 13G/A filed by Columbia Wanger Asset Management, L.P. (“CWAM”), WAM Acquisition GP, Inc. (“WAM GP”), and Columbia Acorn Trust (“Acorn” and, together with CWAM and WAM GP, “Columbia”), with the SEC on February 12, 2004. Columbia reported that it has shared voting and shared dispositive power with respect to 1,902,600 shares. |

19

Leases with Principal Stockholders

As of March 2004, the company leases the studios and tower and antenna sites described in the table below from Messrs. Atsinger and Epperson or trusts and partnerships created for the benefit of Messrs. Atsinger and Epperson and their families. All such leases have cost of living adjustments. Based upon management’s assessment and analysis of local market conditions for comparable properties, the company believes that such leases do not have terms that vary materially from those that would have been available from unaffiliated parties.

| Market |

Station Call Letters |

Facilities Leased |

Current Annual Rental |

Expiration Date(1) |

||||||

| Los Angeles, CA |

KRLH-AM | Office/Studios | $ | 24,000 | 2011 | |||||

| Chicago, IL |

WZFS-FM | Antenna/Tower | $ | 134,652 | 2009 | |||||

| San Francisco, CA |

KFAX-AM | Antenna/Tower | $ | 159,984 | 2008 | |||||

| Philadelphia, PA |

WFIL-AM/ WZZD-AM |

Antenna/Tower/Studios | $ | 123,120 | 2009 | |||||

| Houston-Galveston, TX |

KKHT-AM/ KTEK-AM |

Antenna/Tower Antenna/Tower |

$ $ |

35,352 18,444 |

2005 2008 |

| ||||

| Seattle-Tacoma, WA |

KGNW-AM/ KLFE-AM |

Antenna/Tower Antenna/Tower |

$ $ |

40,020 29,088 |

2007 2009 |

| ||||

| Minneapolis-St. Paul, MN |

KKMS-AM/ KYCR-AM |

Antenna/Tower/Studios | $ | 148,392 | 2006 | |||||

| Pittsburgh, PA |

WORD-FM | Antenna/Tower | $ | 29,820 | 2008 | |||||

| Denver-Boulder, CO |

KRKS-AM/ KNUS-AM |

Antenna/Tower Antenna/Tower |

$ $ |