This prospectus supplement relates to an effective registration statement under the Securities Act of 1933, but is not complete and may be changed. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Filed Pursuant to Rule 424(b)(5)

Registration No. 333-86580

SUBJECT TO COMPLETION, DATED APRIL 26, 2004

PRELIMINARY PROSPECTUS SUPPLEMENT TO PROSPECTUS DATED MAY 20, 2002

3,100,000 Shares

Class A Common Stock

We are offering 2,325,000 shares of our Class A common stock. Selling stockholders are offering 775,000 shares of our Class A common stock. We will not receive any of the proceeds from the sale of the shares by the selling stockholders.

Our Class A common stock is quoted on the Nasdaq National Market under the symbol “SALM.” On April 23, 2004, the last reported sale price of our Class A common stock on the Nasdaq National Market was $33.08 per share.

The underwriters have an option to purchase a maximum of 400,000 additional shares of Class A common stock from us and the selling stockholders to cover over-allotments.

Investing in our Class A common stock involves risks. See the section entitled “Risk Factors” beginning on page S-9 of this prospectus supplement.

| Price to Public |

Underwriting Discounts and Commissions |

Proceeds to Salem |

Proceeds to Selling Stockholders | |||||

| Per Share |

$ | $ | $ | $ | ||||

| Total |

$ | $ | $ | $ |

Delivery of the shares of Class A common stock will be made on or about , 2004.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined this prospectus supplement or the prospectus to which it relates is truthful or complete. Any representation to the contrary is a criminal offense.

| Joint Book-Running Managers | ||

| Credit Suisse First Boston | Deutsche Bank Securities | |

UBS Investment Bank | ||

| Jefferies & Company, Inc. | SunTrust Robinson Humphrey | |

The date of this prospectus supplement is , 2004.

| Prospectus Supplement |

Page | |

| ii | ||

| ii | ||

| iii | ||

| S-1 S-9 | ||

| S-17 | ||

| S-17 | ||

| S-18 | ||

| S-19 | ||

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

S-22 | |

| S-38 | ||

| S-43 | ||

| S-50 | ||

| S-53 | ||

| S-55 | ||

|

CERTAIN UNITED STATES FEDERAL INCOME AND ESTATE TAX CONSEQUENCES

TO |

S-56 | |

| S-59 | ||

| S-62 | ||

| S-62 | ||

| S-62 | ||

| S-62 |

| Prospectus |

Page | |

| 1 | ||

| 2 | ||

| 3 | ||

| 3 | ||

| 4 | ||

| 40 | ||

| 47 | ||

| 48 | ||

| 49 | ||

| 51 | ||

| 52 | ||

| 54 | ||

| 54 | ||

| 55 | ||

| 56 | ||

| 56 |

You should rely only on the information contained or incorporated by reference in this prospectus supplement and the accompanying prospectus that is also a part of this document. We have not authorized anyone to provide information different from that contained or incorporated in this prospectus supplement and the accompanying prospectus. We are offering to sell, and seeking offers to buy, shares of our Class A common stock only in jurisdictions where offers and sales are permitted. The information contained or incorporated in this prospectus supplement and the accompanying prospectus is accurate only as of the date of such information, regardless of the time of delivery of this prospectus supplement and the accompanying prospectus or of any sale of our Class A common stock.

i

ABOUT THIS PROSPECTUS SUPPLEMENT

This prospectus supplement is a supplement to the accompanying prospectus that is also a part of this document. This prospectus supplement and the accompanying prospectus are part of a registration statement that we filed with the SEC that utilizes a shelf registration process. Under the shelf registration process, we and Salem Holding may sell certain of our securities, up to a total maximum aggregate offering price of $110,025,000 and the selling stockholders may sell up to an aggregate of 1,250,000 shares of our Class A common stock, of which this offering is a part. In this prospectus supplement, we provide you with specific information about the terms of this offering and certain other information. Both this prospectus supplement and the accompanying prospectus include important information about us and the selling stockholders, our Class A common stock being offered hereby and other information you should know before investing in our Class A common stock.

In this prospectus supplement, the terms “we,” “us,” “our” and “ours” refer to Salem Communications Corporation, a Delaware corporation, and its consolidated subsidiaries. Our subsidiary, Salem Communications Holding Corporation, is referred to throughout this prospectus supplement as “Salem Holding” and Salem Communications Corporation, excluding its subsidiaries, is referred to as “Salem.” The term “our Class A common stock” means the Class A common stock, par value $0.01 per share, of Salem. The term “our Class B common stock” means the Class B common stock, par value $0.01 per share, of Salem. The term “selling stockholders” refers to Edward G. Atsinger III, Stuart W. Epperson and trusts and other entities through which they have beneficial ownership.

You should read both this prospectus supplement and the accompanying prospectus, as well as the additional information described under the section entitled “Where You Can Obtain More Information” on page S-62 of this prospectus supplement, before investing in our Class A common stock. This prospectus supplement adds to, updates and changes information contained in the accompanying prospectus and previously filed information incorporated by reference. To the extent that any statement that we make in this prospectus supplement is inconsistent with the statements made in the accompanying prospectus or the previously filed information incorporated by reference, the statements made in the accompanying prospectus or the previously filed information incorporated by reference are deemed modified or superseded by the statements made in this prospectus supplement.

We have not taken any action to permit a public offering of the shares of securities outside the United States. Persons outside the United States who come into possession of this prospectus supplement must inform themselves about and observe any restrictions relating to the offering of the shares of Class A common stock and the distribution of this prospectus supplement outside the United States.

MARKET AND INDUSTRY DATA

The market data included in this prospectus supplement, including information relating to our relative position in the broadcast industry, is based on internal surveys, market research, publicly available information and industry publications. Although we believe that such independent sources are reliable, we have not independently verified the information contained in them, and we cannot guarantee the accuracy or completeness of this information. Unless otherwise noted, individual radio stations are described in this prospectus supplement with reference to the markets they serve and not the city and state of license.

All metropolitan statistical area (“MSA”) rank information used in this prospectus supplement is from the Fall 2003 Radio Market Survey Schedule & Population Rankings (“Radio Market Survey”) published by The Arbitron Company, excluding the Commonwealth of Puerto Rico. According to the Radio Market Survey, the population estimates used were based upon 2000 U.S. Bureau Census estimates updated and projected to January 2004 by Claritas, Inc.

ii

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus supplement and the information incorporated herein by reference contains forward-looking statements that are subject to risks, uncertainties and assumptions. You should not place undue reliance on these statements. Forward-looking statements include information concerning possible or assumed future results of operations, including descriptions of business strategies. These statements often include words such as “believes,” “expects,” “anticipates,” “intends,” “plans,” “estimates,” “seeks,” “will,” “may” or similar expressions. These statements are based on certain assumptions that have been made in light of experience as well as perceptions of historical trends, current conditions, expected future developments and other factors we believe are appropriate in these circumstances. As you read and consider this prospectus supplement, you should understand that these statements are not guarantees of performance or results. Many factors could affect actual financial results or results of operations or could cause actual results to differ materially from those in the forward-looking statements. These factors include, but are not limited to:

| • | operations and prospects; |

| • | our ability to successfully acquire and integrate new radio stations; |

| • | business and financing plans; |

| • | the cost and availability of financing sources; |

| • | future growth of the religious and family issues format segment of the radio broadcasting industry; |

| • | characteristics of competition; |

| • | actions of third parties such as government regulatory agencies; and |

| • | various other factors beyond our control including those described in the section entitled “Risk Factors” beginning on page S-9 of this prospectus supplement. |

All future written and oral forward-looking statements by us or persons acting on our behalf are expressly qualified in their entirety by the cautionary statements contained in this prospectus supplement, and in any document incorporated herein or therein, by reference. We do not have any obligation or intention to release publicly any revisions to any forward-looking statements to reflect events or circumstances in the future or to reflect the occurrence of unanticipated events. We nonetheless reserve the right to make such updates from time to time by press release, periodic report or other method of public disclosure without the need for specific reference to this prospectus supplement. No such update shall be deemed to indicate that other statements not addressed by such update remain correct or create an obligation to provide any other updates.

iii

PROSPECTUS SUPPLEMENT SUMMARY

This is only a summary of the offering. It contains information about us and the offering. It may not contain all of the information that may be important to you. To fully understand the investment you are contemplating, you should read carefully this prospectus supplement, including the “Risk Factors” section, the accompanying prospectus and the detailed information incorporated into each of them by reference before you make an investment decision. Unless otherwise indicated, all information in this prospectus supplement assumes no exercise of the over-allotment option to purchase additional shares of Class A common stock granted to the underwriters by us and the selling stockholders. The description of our business assumes completion of all announced transactions.

Salem Communications Corporation

We believe that we are the largest commercial U.S. radio broadcasting company, measured by number of stations and audience coverage, providing programming targeted at audiences interested in religious and family themes. Upon completion of all announced transactions, we will own a national portfolio of 95 radio stations in 37 markets, including 60 stations in 23 of the top 25 markets, which consists of 28 FM stations and 67 AM stations. Upon completion of all announced transactions, we will be one of only four commercial radio broadcasters with radio stations in all of the top 10 markets. We are the sixth largest operator measured by number of stations overall and the third largest operator measured by number of stations in the top 25 markets. Management believes that we are the fourteenth largest radio broadcaster measured by net broadcasting revenue for the year ended December 31, 2003.

We also own Salem Radio Network®, which is a developer, producer and syndicator of religious and family themed talk, news and music programming with approximately 1,600 affiliated radio stations. In addition, we own Internet and publishing businesses which target our radio audiences.

Our business strategy is to expand and improve our national multimedia platform in order to deliver compelling content to audiences interested in religious and family themes. We primarily program our stations with our Christian teaching and talk format, which is talk programming with religious and family themes. We also feature news/talk and contemporary Christian music formats. Salem Radio Network® supports our strategy by allowing us to reach listeners in markets where we do not own or operate radio stations.

Both our chief executive officer and our chairman are career radio broadcasters who have owned and operated radio stations for more than 30 years. We believe our management team has successfully executed a strategy of identifying, acquiring and operating radio stations.

Large and Growing Target Audiences

We believe our operations focus on a highly attractive and growing market:

| • | 38% growth in listenership over the past five years has made religious radio the fastest growing format in radio (Arbitron, Inc.); |

| • | 85% of Americans rely on faith to bring meaning and purpose to their lives (Gallup Organization Study, January 2003); |

| • | 41% of Americans say they have attended church in their last seven days (Gallup Organization Study, March 2004); |

| • | religious formats combined (including Religion (teaching/variety), contemporary Christian, Southern Gospel, Black Gospel and Gospel formats) represent the third largest radio format in the U.S. measured by number of commercial and noncommercial stations (The M Street Radio Directory); and |

| • | annual sales of Christian/Gospel music as a percentage of total U.S. genre album sales have grown from 6.0% in 2000 to 7.0% in 2003 (Soundscan). |

S-1

Growth and Operating Strategies

Continue to Focus on and Serve Targeted Audiences. A key attribute of our success is our consistent focus on reaching the audiences interested in religious and family themes. We have demonstrated a long-term commitment to these audiences by operating radio stations with formats directed to our listeners’ specific needs and interests.

Emphasize Compelling Content. As more listening, reading and viewing options become available, compelling content is a key to expanding our listening audiences and increasing audience response to our advertisers. Each of our primary formats enhances our strategy of delivering compelling programming content and enables us to broaden our appeal to our target audiences. Our national radio network will continue to look for new block programming, compete aggressively for talk show talent, expand and refine our music networks, and develop compelling news and public affairs features.

Build Format Awareness. We seek to build local format awareness for each of our radio stations in order to retain and increase our listening audiences, expand our base of advertisers and provide increased audience response to our block programming clients. We emphasize the development of a radio station’s identity to allow each radio station to better compete by developing local on-air personalities, improving production quality and technical facilities, and increasing promotional activities.

Build Radio Station Clusters. By operating clusters of stations within the same market, we are able to broaden our appeal to our target audiences by broadcasting a range of formats, offer customers multiple programming options to advertise their products and achieve cost savings by integrating our operations.

Pursue Strategic Radio Acquisitions in Large Metropolitan Markets. We intend to pursue acquisitions of radio stations in both new and existing markets, particularly in large metropolitan areas. Because we believe our presence in large markets makes us attractive to national block programmers and national advertisers, we will continue to pursue acquisitions of radio stations in selected top 50 markets where we currently do not own stations. Upon the completion of all announced transactions, we will own stations in 30 of the top 50 markets.

Consider Strategic Diversification. We will continue to consider opportunities in other forms of media that complement our primary radio formats. This strategy will allow us to build upon our expertise in serving the audiences interested in religious and family themes.

Utilize Market Research, Targeted Programming and Marketing. We use market research in certain key markets to tailor our programming, marketing and promotion of our music and news/talk stations to maximize audience share in these markets. This research helps us identify underserved or unserved markets or segments of the audiences interested in religious and family themes.

Organizational Structure

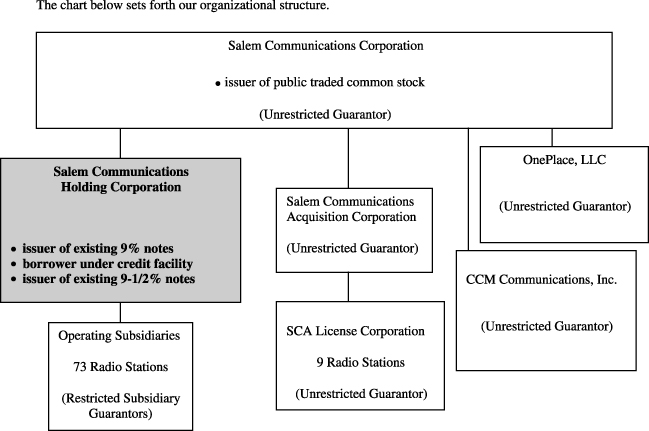

Salem Communications Corporation (“Salem”) was formed in 1986 as a California corporation and was reincorporated in Delaware in 1999. Salem Communications Holding Corporation (“Salem Holding”) was formed as a wholly-owned subsidiary of Salem in May 2000. Also in May 2000, we formed an additional wholly-owned subsidiary, Salem Communications Acquisition Corporation (“Salem Acquisition”), which has since acquired nine radio stations through its wholly-owned subsidiary SCA License Corporation. In August 2000, Salem assigned substantially all of its assets and liabilities, other than stock of Salem Holding and Salem Acquisition, to Salem Holding.

In June 2001, Salem Holding effected a dividend to Salem of Salem Holding’s Internet and publishing businesses. This transaction was effected as a dividend of the capital stock and membership interests,

S-2

respectively, of Salem Holding’s wholly-owned subsidiaries, CCM Communications, Inc. and OnePlace, LLC. As a result, CCM and OnePlace became direct subsidiaries of Salem. Subsequently, the membership interests of OnePlace were contributed to SCA License Corporation, and OnePlace became an indirect subsidiary of Salem. Salem and all of its subsidiaries (other than Salem Holding) are guarantors of the borrowings under Salem Holding’s credit facility, as well as the existing 9% senior subordinated notes and 7¾% senior subordinated notes issued by Salem Holding and guaranteed by Salem and its other direct and indirect subsidiaries.

Recent Financial Developments

On April 26, 2004, we announced our operating results for the three months ended March 31, 2004. The following unaudited summary consolidated financial data should be read in conjunction with the “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the financial information included in this prospectus supplement.

| Three Months Ended March 31, |

||||||||

| 2003 |

2004 |

|||||||

| (In thousands, except share and per share data) (unaudited) |

||||||||

| Statement of Operations Data: |

||||||||

| Net broadcasting revenue |

$ | 38,706 | $ | 43,157 | ||||

| Other media revenue |

1,921 | 1,946 | ||||||

| Total revenue |

40,627 | 45,103 | ||||||

| Operating expenses: |

||||||||

| Broadcasting operating expenses |

26,338 | 27,544 | ||||||

| Cost of denied tower site and license upgrade |

2,202 | — | ||||||

| Other media operating expenses |

1,860 | 2,162 | ||||||

| Corporate expenses |

4,044 | 4,304 | ||||||

| Depreciation and amortization |

3,025 | 3,097 | ||||||

| Total operating expenses |

37,469 | 37,107 | ||||||

| Operating income |

3,158 | 7,996 | ||||||

| Other income (expense): |

||||||||

| Interest income |

154 | 29 | ||||||

| Loss on sale of assets |

— | (224 | ) | |||||

| Interest expense |

(6,636 | ) | (5,670 | ) | ||||

| Loss on early retirement of debt |

(6,440 | ) | — | |||||

| Other expense |

(69 | ) | (111 | ) | ||||

| Total other income (expense) |

(12,991 | ) | (5,976 | ) | ||||

| Income (loss) before income taxes |

(9,833 | ) | 2,020 | |||||

| Provision (benefit) for income taxes |

(3,745 | ) | 758 | |||||

| Net income (loss) |

$ | (6,088 | ) | $ | 1,262 | |||

| Basic earnings (loss) per share: |

$ | (0.26 | ) | $ | 0.05 | |||

| Diluted earnings (loss) per share: |

$ | (0.26 | ) | $ | 0.05 | |||

| Basic weighted average shares outstanding |

23,484,113 | 23,526,105 | ||||||

| Diluted weighted average shares outstanding |

23,484,113 | 23,678,124 | ||||||

S-3

| Three Months Ended March 31, |

||||||||

| 2003 |

2004 |

|||||||

| (In thousands) | ||||||||

| (unaudited) | ||||||||

| Balance Sheet Data (at end of period): | ||||||||

| Cash and cash equivalents |

$ | 1,448 | $ | 4,159 | ||||

| Broadcast licenses |

363,232 | 381,740 | ||||||

| Other intangible assets including goodwill, net |

16,920 | 15,011 | ||||||

| Total assets |

553,277 | 556,776 | ||||||

| Long-term debt, including current portion |

323,318 | 331,863 | ||||||

| Total stockholders’ equity |

$ | 165,840 | $ | 173,676 | ||||

| Other Data: |

||||||||

| Station operating income(1) |

$ | 12,368 | $ | 15,613 | ||||

| Station operating income margin(2) |

32.0 | % | 36.2 | % | ||||

| (1) | We define station operating income as net broadcasting revenue less broadcasting operating expenses. Although station operating income is not a measure of performance calculated in accordance with generally accepted accounting principles (“GAAP”), it should be viewed as a supplement to and not a substitute for results of operations presented on the basis of GAAP. Management believes that station operating income is useful, when considered in conjunction with operating income, the most directly comparable GAAP financial measure, because it is generally recognized by the radio broadcasting industry as a tool in measuring performance and in applying valuation methodologies for companies in the media, entertainment and communications industries. This measure is used by investors and by analysts who report on the industry to provide comparisons between broadcast groups. Additionally, we use station operating income as one of our key measures of operating efficiency and profitability. Station operating income does not purport to represent cash provided by operating activities. Our statement of cash flows presents our cash flow activity and our income statement presents our historical performance prepared in accordance with GAAP. Our station operating income is not necessarily comparable to similarly titled measures employed by other companies. |

| The following table provides a reconciliation of station operating income (a non-GAAP financial measure) to operating income (the most directly comparable GAAP financial measure, as presented in our financial statements) for the periods presented: |

| Three Months Ended March 31, |

||||||||

| 2003 |

2004 |

|||||||

| Station operating income |

$ | 12,368 | $ | 15,613 | ||||

| Plus other media revenue |

1,921 | 1,946 | ||||||

| Less cost of denied tower site and license upgrade |

(2,202 | ) | — | |||||

| Less other media operating expenses |

(1,860 | ) | (2,162 | ) | ||||

| Less depreciation and amortization |

(3,025 | ) | (3,097 | ) | ||||

| Less corporate expenses |

(4,044 | ) | (4,304 | ) | ||||

| Operating income |

$ | 3,158 | $ | 7,996 | ||||

| (2) | Station operating income margin is station operating income as a percentage of net broadcasting revenue. |

Recently Announced Acquisitions

We have recently announced that we have agreements to acquire the following three radio stations:

| Transaction |

Market |

Station(s) |

MSA |

Purchase Price | |||||

| Station Acquisition |

Detroit, MI | WQBH-AM | 10 | $ | 4,750,000 | ||||

| Station Acquisition |

Atlanta, GA | WAFS-AM | 11 | $ | 16,413,350 | ||||

| Station Acquisition |

Honolulu, HI | KJPN-AM | 60 | $ | 500,000 | ||||

| (1) | “MSA” means metropolitan statistical area. |

Corporate Information

Our principal executive offices are located at 4880 Santa Rosa Road, Camarillo, California 93012, and our telephone number is (805) 987-0400. Our website is located at www.salem.cc. The information contained on or linked to our website is not a part of or incorporated into this prospectus supplement.

S-4

The Offering

Class A common stock being offered by:

| Salem Communications Corporation |

2,325,000 shares |

| The selling stockholders |

775,000 shares |

| Total |

3,100,000 shares |

| Class A common stock outstanding immediately after this offering |

20,315,417 shares |

| Voting rights |

Each share of Class A common stock is entitled to one vote. We also have Class B common stock, all of which is beneficially owned directly or indirectly by Edward G. Atsinger III or Stuart W. Epperson through trusts and other entities. Each share of our Class B common stock is generally entitled to 10 votes. Holders of our Class A common stock and Class B common stock generally vote together as a single class on all matters submitted to a vote of stockholders. Shares of our Class A common stock and Class B common stock do not have cumulative voting rights with respect to the election of directors. |

| Dividend policy |

Historically, we have not paid a dividend on either class of our common stock. We have historically retained earnings for use in our business and will continue to do so unless our board of directors makes a determination to declare and pay dividends on our common stock in light of and after consideration of our earnings, financial position, capital requirements, our bank credit facility, the indentures governing our senior subordinated notes and such other factors as the board of directors deems relevant. |

| Use of proceeds |

We intend to use the net proceeds from this offering for working capital and general corporate purposes, which may include the redemption of up to approximately $52.5 million principal amount of the outstanding 9% senior subordinated notes due 2011. For more details, see the section entitled “Use of Proceeds” in this prospectus supplement. We will not receive any proceeds from the sale of the shares of Class A common stock by the selling stockholders. |

| Nasdaq National Market symbol |

SALM |

| Risk factors |

Before deciding to invest in shares of our Class A common stock, you should read the section entitled “Risk Factors” beginning on page S-9 of this prospectus supplement, as well as other cautionary statements throughout this entire prospectus supplement and the documents incorporated by reference herein and therein. |

S-5

Unless we specifically state otherwise, the information in this prospectus supplement:

| • | excludes the sale of up to 400,000 shares of Class A common stock, which the underwriters have the option to purchase from us and the selling stockholders to cover over-allotments; and |

| • | excludes 758,416 shares of Class A common stock reserved at April 15, 2004, for issuance upon exercise of outstanding options under our stock incentive plan. |

In addition, unless we specifically state otherwise, the number of shares of our common stock outstanding in this prospectus is based on the number of shares of our Class A common stock outstanding as of April 15, 2004.

S-6

Summary Consolidated Financial and Other Data

The summary consolidated financial and other data presented below for the three years ended December 31, 2003, have been derived from our audited consolidated financial statements. The summary consolidated financial and other data below should be read in conjunction with the sections entitled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Selected Consolidated Financial Information and Other Data” and our consolidated financial statements and the notes thereto included in our Annual Report on Form 10-K for the year ended December 31, 2003.

| Year Ended December 31, |

||||||||||||

| 2001 |

2002 |

2003 |

||||||||||

| (In thousands, except share and per share data) | ||||||||||||

| Statement of Operations Data: |

||||||||||||

| Net broadcasting revenue |

$ | 136,106 | $ | 156,216 | $ | 170,483 | ||||||

| Other media revenue |

8,016 | 8,054 | 7,865 | |||||||||

| Total revenue |

144,122 | 164,270 | 178,348 | |||||||||

| Operating expenses: |

||||||||||||

| Broadcasting operating expenses |

87,772 | 103,809 | 109,043 | |||||||||

| Cost of denied tower site and |

— | — | 2,202 | |||||||||

| Other media operating expenses |

9,282 | 7,709 | 7,942 | |||||||||

| Legal settlement |

— | 2,300 | — | |||||||||

| Corporate expenses |

13,774 | 14,387 | 16,091 | |||||||||

| Cost of terminated offering |

— | — | 651 | |||||||||

| Depreciation and amortization |

30,026 | 11,446 | 12,291 | |||||||||

| Total operating expenses |

140,854 | 139,651 | 148,220 | |||||||||

| Operating income |

3,268 | 24,619 | 30,128 | |||||||||

| Other income (expense): |

||||||||||||

| Interest income |

1,994 | 255 | 212 | |||||||||

| Gain (loss) on sale of assets |

26,276 | (567 | ) | (214 | ) | |||||||

| Gain on sale of assets to related party |

3,560 | — | — | |||||||||

| Interest expense |

(26,542 | ) | (27,162 | ) | (23,474 | ) | ||||||

| Loss on early retirement of debt |

— | — | (6,440 | ) | ||||||||

| Other expense |

(573 | ) | (458 | ) | (410 | ) | ||||||

| Total other income (expense) |

4,715 | (27,932 | ) | (30,326 | ) | |||||||

| Income (loss) before income taxes and discontinued operations |

7,983 | (3,313 | ) | (198 | ) | |||||||

| Provision (benefit) for income taxes |

2,442 | (1,323 | ) | 479 | ||||||||

| Income (loss) before discontinued operations |

5,541 | (1,990 | ) | (677 | ) | |||||||

| Discontinued operations, net of tax |

(1,154 | ) | 15,995 | — | ||||||||

| Net income (loss) |

$ | 4,387 | $ | 14,005 | $ | (677 | ) | |||||

| Basic earnings (loss) per share data: |

||||||||||||

| Earnings (loss) before discontinued operations |

$ | 0.24 | $ | (0.08 | ) | $ | (0.03 | ) | ||||

| Income (loss) from discontinued operations |

(0.05 | ) | 0.68 | — | ||||||||

| Net income (loss) per share |

0.19 | 0.60 | (0.03 | ) | ||||||||

| Diluted earnings (loss) per share data: |

||||||||||||

| Earnings (loss) before discontinued operations |

$ | 0.24 | $ | (0.08 | ) | $ | (0.03 | ) | ||||

| Income (loss) from discontinued operations |

(0.05 | ) | 0.68 | — | ||||||||

| Net income (loss) per share |

0.19 | 0.59 | (0.03 | ) | ||||||||

| Basic weighted average shares outstanding |

23,456,828 | 23,473,821 | 23,488,898 | |||||||||

| Diluted weighted average shares outstanding |

23,518,747 | 23,582,906 | 23,488,898 | |||||||||

S-7

| As of December 31, |

||||||||||||

| 2001 |

2002 |

2003 |

||||||||||

| (In thousands) | ||||||||||||

| Balance Sheet Data: |

||||||||||||

| Cash and cash equivalents |

$ | 23,291 | $ | 26,325 | $ | 5,620 | ||||||

| Restricted cash |

— | 107,661 | — | |||||||||

| Broadcast licenses |

323,848 | 363,203 | 381,740 | |||||||||

| Other intangible assets, including goodwill, net |

20,211 | 17,305 | 15,391 | |||||||||

| Total assets |

507,254 | 672,209 | 560,011 | |||||||||

| Long-term debt, less current portion |

311,621 | 350,908 | 336,091 | |||||||||

| Stockholders’ equity |

$ | 157,370 | $ | 171,928 | $ | 171,822 | ||||||

| Year Ended December 31, |

||||||||||||

| 2001 |

2002 |

2003 |

||||||||||

| (In thousands) | ||||||||||||

| Cash Flows Related To: |

||||||||||||

| Operating activities |

$ | 11,633 | $ | 6,814 | $ | 24,034 | ||||||

| Investing activities |

(10,070 | ) | (27,018 | ) | (29,688 | ) | ||||||

| Financing activities |

18,430 | 22,608 | (15,051 | ) | ||||||||

| Other Data: |

||||||||||||

| Station operating income(1) |

$ | 48,334 | $ | 52,407 | $ | 61,440 | ||||||

| Station operating income margin(2) |

35.5 | % | 33.5 | % | 36.0 | % | ||||||

| (1) | We define station operating income as net broadcasting revenue less broadcasting operating expenses. Although station operating income is not a measure of performance calculated in accordance with GAAP, it should be viewed as a supplement to and not a substitute for results of operations presented on the basis of GAAP. Management believes that station operating income is useful, when considered in conjunction with operating income, the most directly comparable GAAP financial measure, because it is generally recognized by the radio broadcasting industry as a tool in measuring performance and in applying valuation methodologies for companies in the media, entertainment and communications industries. This measure is used by investors and by analysts who report on the industry to provide comparisons between broadcast groups. Additionally, we use station operating income as one of our key measures of operating efficiency and profitability. Station operating income does not purport to represent cash provided by operating activities. Our statement of cash flows presents our cash flow activity and our income statement presents our historical performance prepared in accordance with GAAP. Our station operating income is not necessarily comparable to similarly titled measures employed by other companies. |

The following table provides a reconciliation of station operating income (a non-GAAP financial measure) to operating income (the most directly comparable GAAP financial measure, as presented in our financial statements) for the periods presented:

| Year Ended December 31, |

||||||||||||

| 2001 |

2002 |

2003 |

||||||||||

| (In thousands) | ||||||||||||

| Station operating income |

$ | 48,334 | $ | 52,407 | $ | 61,440 | ||||||

| Plus other media revenue |

8,016 | 8,054 | 7,865 | |||||||||

| Less cost of denied tower site and license upgrade |

— | — | (2,202 | ) | ||||||||

| Less other media operating expenses |

(9,282 | ) | (7,709 | ) | (7,942 | ) | ||||||

| Less depreciation and amortization |

(30,026 | ) | (11,446 | ) | (12,291 | ) | ||||||

| Less corporate expenses |

(13,774 | ) | (14,387 | ) | (16,091 | ) | ||||||

| Less cost of terminated offering |

— | — | (651 | ) | ||||||||

| Less legal settlement |

— | (2,300 | ) | — | ||||||||

| Operating income |

$ | 3,268 | $ | 24,619 | $ | 30,128 | ||||||

| (2) | Station operating income margin is station operating income as a percentage of net broadcasting revenue. |

S-8

RISK FACTORS

An investment in our Class A common stock involves a high degree of risk. Before investing in the Class A common stock offered hereby, you should carefully consider the risk factors set forth below, as well as the other information included in this prospectus supplement, the accompanying prospectus and the information incorporated by reference in each of them.

Risks Related to Our Business

We may choose not to pursue potentially more profitable business opportunities outside of our religious and family themes formats, or not to broadcast programming that violates our programming standards, either of which may have a material adverse effect on our business.

We are fundamentally committed to broadcasting formats and programming emphasizing religious and family themes. We may choose not to switch to other formats or pursue potentially more profitable business opportunities in response to changing audience preferences. We do not intend to pursue business opportunities or air programming that would conflict with our core commitment to religious and family themes formats or that would violate our programming standards, even if such opportunities or programming would be more profitable. Our decision not to pursue other formats or air programming inconsistent with our programming standards might result in lower operating revenues and profits than we might otherwise achieve.

If we are unable to execute our acquisition strategy successfully, our business may not continue to grow.

We intend to continue to acquire radio stations as well as other complementary media businesses. Our acquisition strategy has been, and will continue to focus on, the acquisition of radio stations in the top 50 markets. However, we may not be able to identify and consummate future acquisitions successfully, and stations that we do acquire may not increase our station operating income or yield other anticipated benefits. Acquisitions in markets in which we already own stations may not increase our station operating income due to saturation of audience demand. Acquisitions in smaller markets may have less potential to increase operating revenues. Our failure to execute our acquisition strategy successfully in the future could limit our ability to continue to grow in terms of number of stations or profitability.

We may be unable to integrate the operations and management of acquired stations or businesses, which could have a material adverse effect on our business and operating results.

Since January 1, 2002, we have acquired the assets of 13 radio stations and an Internet business, and we expect to make acquisitions of other stations and related businesses in the future. We cannot assure you that we will be able to successfully integrate the operations or management of acquired stations and businesses, or the operations or management of stations and businesses that might be acquired in the future. Acquisitions of stations will require us to manage a larger and likely more geographically diverse radio station portfolio than historically has been the case. Our inability to integrate and manage newly acquired stations or businesses successfully could have a material adverse effect on our business and operating results.

If we are unable to implement our cluster strategy, we may not realize anticipated operating efficiencies.

As part of our operating strategy, we attempt to realize efficiencies of operating costs and cross-selling of advertising by clustering the operations of two or more radio stations in a single market. However, there can be no assurances that this operating strategy will be successful. Furthermore, we cannot assure you that the clustering of radio stations in one market will not result in downward pressure on advertising rates at one or more of the existing or new radio stations within the cluster. There can be no assurance that any of our stations will be able to maintain or increase its current listening audiences and operating revenue in circumstances where we implement our clustering strategy.

Additionally, Federal Communications Commission (“FCC”) rules and policies allow a broadcaster to own a number of radio stations in a given market and permit, within limits, joint arrangements with other stations in a

S-9

market relating to programming, advertising sales and station operations. We believe that radio stations that elect to take advantage of these clustering opportunities may, in certain circumstances, have lower operating costs and may be able to offer advertisers more attractive rates and services. The future development of our business in new markets, as well as the maintenance of our business growth in those markets in which we do not currently have radio station clusters, may be negatively impacted by competitors who are taking advantage of these clustering opportunities by operating multiple radio stations within markets.

The restrictions on ownership of multiple stations in each market may prevent us from implementing our cluster strategy.

As part of our growth strategy, we seek to acquire additional radio stations in markets in which we already have existing stations. However, our ability to acquire, operate and integrate any such future acquisition as part of a cluster may be limited by antitrust laws, FCC regulations, the amendment of the Federal Communications Act of 1934 (the “Communications Act”) through congressional action or other applicable laws and regulations. Such changes may affect our ability to acquire additional stations in local radio markets where we already own one or more radio stations.

In 2003, the FCC modified its definition of the term “market” for purposes of its local radio multiple ownership rules. The text of the new market definition rule and the text of the FCC order modifying the market definition rule have not yet become effective due to a stay granted by the 3rd Circuit Court of Appeals and ongoing discussions in the United States Congress concerning the rules. Based solely on the current draft of FCC rules, which is not yet a legally binding FCC obligation or requirement and which may be modified or eliminated as a result of pending legal and legislative action (the “Proposed Rule”), it appears that, in other than smaller radio markets, the FCC has replaced its “signal contour method” of defining local radio markets with the use of “geographic markets” delineated by The Arbitron Company, which is a commercial radio ratings service. Based solely on the Proposed Rule, it appears that, in smaller radio markets which Arbitron has not delineated geographic markets, the FCC will be conducting a rulemaking to establish “defined markets” comparable to the geographic markets delineated by Arbitron in larger markets. The modified market definition rule is not yet in effect and remains subject to judicial review.

Based solely on the Proposed Rule, the modified market definition is expected to more severely limit the number of radio stations we may acquire in many markets and to more severely limit the buyers to whom we may sell stations in the future and therefore adversely affect our ability to build or enhance our radio station clusters.

Based solely on the Proposed Rule, it appears that the FCC will not apply the modified market definition retroactively and instead will grandfather currently owned, operated, and controlled clusters of radio stations which otherwise do not comply with the modified market definition. Based solely on the Proposed Rule, it appears that the grandfathering provision of the modified market definition will not require a change in our current ownership of radio broadcast stations.

We cannot predict whether the Proposed Rule will be issued in its current form or whether it will vary materially from this summary. For this reason, we cannot predict the impact of the Proposed Rule on our business operations.

In addition, interest has been expressed by members of Congress to further limit the level of ownership concentration in local radio markets. We cannot predict whether there will be a change in the Communications Act or other federal law governing ownership of radio stations, or whether the FCC, the Department of Justice (“DOJ”) or the Federal Trade Commission (“FTC”) will modify their rules and policies restricting the acquisition of additional stations in a local radio market. In addition, we cannot predict whether a private party will challenge acquisitions we may propose in the future. These events could adversely affect our ability to implement our cluster acquisition strategy.

S-10

Government regulation of the broadcasting industry by the FTC, DOJ and FCC may limit our ability to acquire or dispose of radio stations and enter into certain agreements.

The Communications Act and FCC rules and policies require prior FCC approval for transfers of control of, and assignments of, FCC licenses. The FTC and the DOJ evaluate transactions to determine whether those transactions should be challenged under federal antitrust laws. Over the past seven years, the FTC and the DOJ have been increasingly active in their review of radio station acquisitions. This is particularly the case when a radio broadcast company proposes to acquire an additional station in an existing market. As we have gained a presence in a greater number of markets and percentage of the top 50 markets, our future proposed transactions may be subject to more frequent and aggressive review by the FTC or the DOJ due to market concentration concerns. This increased level of review may be accentuated in instances where we propose to engage in a transaction with parties who themselves have multiple stations in the relevant market. The FCC might not approve a proposed radio station acquisition or disposition when the DOJ has expressed market concentration concerns with respect to the buy or sell side of a given transaction, even if the proposed transaction would otherwise comply with the FCC’s numerical limits on in-market ownership. We cannot be sure that the DOJ or the FTC will not seek to prohibit or require the restructuring of our future acquisitions on these or other bases.

As noted in the immediately preceding risk factor, the FCC modified its definition of the term “market” for purposes of its local radio multiple ownership rules. The text of the new “market” definition rule and the text of the FCC order modifying the market definition rule are set forth in a Proposed Rule that is not yet effective because of pending legal and legislative action. Based solely on the Proposed Rule, it appears that, the change will further limit our ability to make future radio station acquisitions and will further limit any agreements whereby we provide programming to or sell advertising on radio stations that we do not own. Based solely on the Proposed Rule, it appears that the FCC will prohibit the sale to one entity of an intact, grandfathered cluster of radio stations unless the entity is a small business as defined by the FCC. The FCC definition of “small business” for such sales has not yet been released to the public. Based solely on the Proposed Rule, it appears that the grandfather provision of the modified market definition will limit the buyers to whom we may in the future sell our current clusters of radio stations as a group. Were a complaint to be filed against us or other FCC licensees involved in a transaction with us, the FCC could delay the grant of, or refuse to grant, its consent to an assignment or transfer of control of licenses and effectively prohibit a proposed acquisition or disposition.

If we are not able to obtain financing or generate sufficient cash flows from operations, we may be unable to fund future acquisitions.

We may require significant financing to fund our acquisition strategy. This financing may not be available to us. The availability of funds under the credit facility at any time will be dependent upon, among other factors, our ability to satisfy financial covenants. Our future operating performance will be subject to financial, economic, business, competitive, regulatory and other factors, many of which are beyond our control. Accordingly, we cannot assure you that our future cash flows or borrowing capacity will be sufficient to allow us to complete future acquisitions or implement our business plan, which could have a material negative impact on our business and results of operations.

Our substantial indebtedness and our ability to incur more indebtedness could adversely affect our financial condition.

We currently have a significant amount of indebtedness. At March 31, 2004, our total consolidated indebtedness, excluding the fair market value of the interest rate swap agreement of $6.8 million, was $325.1 million. At March 31, 2004, after giving effect to this offering and the assumed application of our net proceeds therefrom to redeem approximately $52.5 million principal amount of the outstanding 9% senior subordinated notes due 2011, our pro forma total consolidated indebtedness, excluding the fair market value of the interest rate swap agreement of $6.8 million, would have been $272.6 million. Our substantial indebtedness could have important consequences to owners of our Class A common stock, including:

| • | making it more difficult for us to satisfy our obligations with respect to borrowings under the credit facility and the 9% and 7¾% subordinated notes; |

S-11

| • | limiting our ability to obtain additional financing to fund future working capital, capital expenditures, acquisitions and other general corporate requirements; |

| • | requiring us to dedicate a substantial portion of our cash flow from operations to payments on our indebtedness, thereby reducing our ability to use our cash flow to fund future working capital, capital expenditures, acquisitions and other general corporate requirements; |

| • | placing us at a competitive disadvantage relative to those of our competitors that have less indebtedness; |

| • | limiting our flexibility in planning for, or reacting to, changes in our business and the industry that could make us more vulnerable to adverse changes in general economic, industry and competitive conditions and adverse changes in government regulations; and |

| • | subjecting us to higher interest expense in the event of increases in interest rates because some of our indebtedness is at variable rates of interest. |

We may incur additional indebtedness to fund future acquisitions and for other corporate purposes. If new indebtedness is added to our and our subsidiaries’ current indebtedness levels, the related risks that we and they now face could intensify.

If we cannot attract the anticipated listener, programmer and advertiser base for our newly acquired radio stations, we may not recoup associated promotional costs or achieve profitability for these radio stations.

We have recently acquired new radio stations that previously broadcast in formats other than our primary formats. We continue to program some of these recently acquired stations in non-primary formats and we re-program others to one of our primary formats. During, and for a period after, the conversion of a radio station’s format, the radio station typically generates operating losses. The magnitude and duration of these losses depends on a number of factors, including the promotional and marketing costs associated with attracting listeners and advertisers to our radio station’s new format and the success of these efforts. There is no guarantee that the operation of these newly acquired stations or our operations in new formats will attract a sufficient listener and advertiser base. If we are not successful in attracting the listener and advertiser base we anticipate, we may not recoup associated promotional costs or achieve profitability for these radio stations.

If we do not maintain or increase our block programming revenues, our business and operating results may be adversely affected.

The financial success of each of our radio stations that features Christian teaching and talk programming is dependent, to a significant degree, upon our ability to generate revenue from the sale of block programming time to national and local religious organizations, which accounted for 36.4% and 35.3% of our gross broadcasting revenue during the years ended December 31, 2002, and 2003, respectively. We compete for this program revenue with a number of commercial and non-commercial radio stations. Due to the significant competition for this block programming, we may not be able to maintain or increase our current block programming revenue.

If we are unable to maintain or grow our advertising revenues, our business and operating results may be adversely affected.

Our radio stations with our Christian teaching and talk, contemporary Christian music and news/talk formats are substantially dependent upon advertising for their revenues. In the advertising market, we compete for revenue with other commercial religious format and general format radio stations, as well as with other media, including broadcast and cable television, newspapers, magazines, direct mail, Internet and billboard advertising. Due to this significant competition, we may not be able to maintain or increase our current advertising revenue.

A sustained economic downturn could negatively impact our ability to generate advertising and block programming revenue.

We derive a substantial part of our revenues from the sale of advertising on our radio stations. For the years ended December 31, 2001, 2002 and 2003, 45.5%, 50.3%, and 52.2% of our broadcasting revenues, respectively,

S-12

were generated from the sale of advertising. Because advertisers generally reduce their spending during economic downturns, we could be adversely affected by a sustained economic downturn or a national recession. In addition, because a substantial portion of our revenues are derived from local advertisers, our ability to generate advertising revenues in specific markets could be adversely affected by local or regional economic downturns. We are particularly dependent on advertising revenue from stations in the Los Angeles and Dallas markets, which generated 9.0% and 9.1%, respectively, of our gross broadcasting revenues in 2003.

Acts of war and terrorism may reduce our revenue and have other negative effects on our business.

In response to the September 11, 2001, terrorist attacks on New York City and Washington, D.C., we increased our news and community service programming, which decreased the amount of broadcast time available for commercial advertising and block programming. In addition, these events caused advertisers to cancel advertisements on our stations. Continued acts of war and terrorism against the United States, and the country’s response thereto, including the current military actions in Iraq, may also cause a general slowdown in the U.S. advertising market, which could cause our revenues to decline due to advertising and/or programming cancellations, delays or defaults in payment, and other factors. In addition, these events may have other negative effects on our business, the nature and duration of which we cannot predict. If these acts of war or terrorism or weak economic conditions continue or worsen, our financial condition and results of operations may be materially and adversely affected.

If we lose the services of our founders, the management and operation of our business could be disrupted.

Our business is dependent upon the performance and continued efforts of certain key individuals, particularly Edward G. Atsinger III, our President and Chief Executive Officer, and Stuart W. Epperson, our Chairman of the Board. The loss of the services of either of Messrs. Atsinger or Epperson could have a material adverse effect upon us. We have entered into employment agreements with each of Messrs. Atsinger and Epperson. Both agreements expire in June 2004. Mr. Epperson has radio interests unrelated to Salem’s operations that will continue to impose demands on his time. Mr. Atsinger has an interest in an aviation business unrelated to Salem’s operations that will continue to impose demands on his time.

Our controlling stockholders may cause us to act, or refrain from acting, in a way that minority stockholders do not believe is in their best interest.

Upon completion of this offering, Edward G. Atsinger III, Stuart W. Epperson, Nancy A. Epperson and Edward C. Atsinger will control approximately 84% of the voting power of our capital stock. These four stockholders thus have the ability to control fundamental corporate transactions requiring stockholder approval, including but not limited to, the election of all of our directors, except for two directors elected by holders of our Class A common stock, approval of merger transactions involving Salem and the sale of all or substantially all of Salem’s assets. The interests of any of these controlling stockholders may differ from the interests of our other stockholders and one or more of the controlling stockholders could take action or make decisions (or block action or decisions) that are not in the minority stockholders’ best interest.

If we fail to maintain our licenses with the FCC, we would be prevented from operating affected radio stations.

We operate each of our radio stations pursuant to one or more FCC broadcasting licenses. As each license expires, we apply for renewal of the license. However, we cannot be sure that any of our licenses will be renewed, and renewal is subject to challenge by third-parties or to denial by the FCC. The Communications Act and FCC rules and policies require prior FCC approval for transfers of control of, and assignments of, FCC licenses. Were a complaint to be filed against us or other FCC licensees involved in a transaction with us, the FCC could delay the grant of, or refuse to grant, its consent to an assignment or transfer of control of licenses and effectively prohibit a proposed acquisition or disposition. The failure to renew any of our licenses would prevent

S-13

us from operating the affected station and generating revenue from it. If the FCC decides to include conditions or qualifications in any of our licenses, we may be limited in the manner in which we may operate the affected station.

Covenant restrictions under Salem Holding’s credit facility and its indentures governing its outstanding senior subordinated notes may limit our ability to operate our business.

Salem Holding’s credit facility and the indentures governing its notes contain, among other things, covenants that restrict Salem’s, Salem Holding’s and their subsidiaries’ ability to finance future operations or capital needs or to engage in other business activities. The credit facility and each of such indentures restrict, among other things, their ability to:

| • | incur additional debt; |

| • | pay dividends or make distributions; |

| • | purchase or redeem stock; |

| • | make investments and extend credit; |

| • | engage in transactions with affiliates; |

| • | create liens on assets; |

| • | transfer and sell assets; and |

| • | effect a consolidation or merger or sell, transfer, lease, or otherwise dispose of all or substantially all of their assets. |

These restrictions on management’s ability to operate Salem’s and Salem Holding’s business in accordance with their discretion could have a material adverse effect on our business.

The covenants in each indenture of Salem Holding are subject to a number of important limitations and exceptions. These limitations and exceptions will, for example, allow Salem Holding to make certain restricted payments to, and investments in, Salem, subject to specified limitations.

In addition, Salem Holding’s credit facility requires us to maintain specified financial ratios and satisfy certain financial condition tests which may require that we take action to reduce our debt or to act in a manner contrary to our business objectives. Events beyond our control, including changes in general economic and business conditions, may affect our ability to meet those financial ratios and financial condition tests. We cannot assure you that we will meet those tests or that the lenders will waive any failure to meet those tests.

A breach of any of these covenants would result in a default under Salem Holding’s credit facility and its existing indentures. If an event of default occurs under any of these agreements, the lenders could, under the credit facility, elect to declare all amounts outstanding thereunder, together with accrued interest, to be immediately due and payable.

If we are unable to pay our obligations to the lenders under the credit facility or other future senior debt instruments, the lenders could proceed against any or all of the collateral securing the indebtedness to them. The collateral under the credit facility consists of substantially all of our existing assets. In addition, a breach of certain of the restrictions or covenants in these agreements, or an acceleration by these lenders of the obligations to them, would cause a default under Salem Holding’s notes. We may not have, or be able to obtain, sufficient funds to make accelerated payments, including payments on the notes, or to repay the notes in full after we pay the senior secured lenders to the extent of their collateral.

S-14

Risks Related to This Offering

The market price of the Class A common stock may fluctuate widely and trade at prices below the offering price.

The market price of the Class A common stock is volatile and has fluctuated over a wide range from $15.00 per share on March 12, 2003 to $33.65 per share on April 23, 2004. The market price may continue to fluctuate significantly in response to a number of factors, including:

| • | market conditions in our industry; |

| • | announcements or actions by our competitors; |

| • | low trading volume of our Class A common stock; |

| • | sales of large amounts of our Class A common stock in the public market or the perception that such sales could occur; |

| • | quarterly variations in operating results or growth rates; |

| • | differences between our actual operating results and those expected by investors and security analysts; |

| • | changes in securities analysts’ recommendations or projections; |

| • | changes in general valuations for radio broadcasting companies; |

| • | additions to or departures of our key personnel; |

| • | judicial or regulatory actions; |

| • | acts of war or terrorism; and |

| • | general economic conditions. |

Any of these factors could have a material adverse effect on your investment in the Class A common stock and the Class A common stock may trade at prices significantly below the offering price. As a result, you could lose some or all of your investment.

Future sales of our Class A common stock could negatively impact our stock price.

Sales of a substantial number of shares of our Class A common stock in the public market, or the perception that such sales could occur, could negatively impact the market price of our Class A common stock by introducing a large number of sellers or potential sellers to the market. Following this offering, there will be 20,315,417 shares of our Class A common stock outstanding and 5,553,696 shares of our Class B common stock outstanding. The 3,100,000 shares of Class A common stock being sold in this offering will be freely transferable without restriction under the Securities Act of 1933, as amended, by persons other than our affiliates. Salem and certain of our executive officers and directors, including the selling stockholders, are subject to “lock-up” agreements under which they have agreed not to sell or otherwise dispose of any shares of our Class A common stock and our Class B common stock for a period of 90 days after the date of this prospectus supplement without the prior written consent of Credit Suisse First Boston LLC and Deutsche Bank Securities Inc. The lock-up agreements contain exceptions for bona fide gifts to charities and certain of our executive officers will be permitted to make de minimus sales of our Class A common stock during the lock-up period. When the lock-up period expires, substantially all of the shares held by our affiliates will be eligible for sale in the public market, subject to compliance with the manner-of-sale, volume and other limitations of Rule 144 of the Securities Act of 1933, as amended.

We may issue additional equity securities, which would lead to dilution of our issued and outstanding common stock.

The issuance of additional equity securities or securities convertible into equity securities would result in dilution of our existing stockholders’ equity interest. Our board of directors has the authority to issue, without the vote or action of stockholders, shares of preferred stock in one or more series, and has the ability to fix the rights, preferences, privileges and restrictions of any such series. Any such series of preferred stock could contain

S-15

dividend rights, conversion rights, voting rights, terms of redemption, redemption prices, liquidation preferences or other rights superior to the rights of holders of our common stock. As of April 15, 2004, we had no shares of preferred stock outstanding. Our board of directors has no present intention of issuing any preferred stock, but reserves the right to do so in the future. In addition, we have authorized up to 80,000,000 shares of Class A common stock, $0.01 par value per share, of which 17,990,417were outstanding as of April 15, 2004; and up to 20,000,000 shares of Class B common stock, par value $0.01 per share, of which 5,553,696 were outstanding as of April 15, 2004.

S-16

USE OF PROCEEDS

We estimate that our net proceeds from the sale of 2,325,000 shares of the Class A common stock offered by us will be approximately $72.3 million, based on an assumed public offering price of $33.08 per share and after deducting the underwriting discount and estimated offering expenses payable by us, assuming the underwriters do not exercise their over-allotment option. We will not receive any proceeds from the sale of the shares of Class A common stock by the selling stockholders.

We intend to use the net proceeds from this offering for working capital and general corporate purposes, which may include the redemption of existing indebtedness under the outstanding 9% senior subordinated notes due 2011. We are negotiating with our lenders to amend certain provisions under the credit facility to, among other things, permit us to exercise our right to redeem up to approximately $52.5 million principal amount of the outstanding 9% senior subordinated notes due 2011 without reducing our ability to make additional borrowings under the credit facility. If we are not able to timely amend the credit facility in this manner, we may choose to not exercise our right to redeem the 9% notes. If the 9% notes are so redeemed, we will redeem them at a 9% premium. At March 31, 2004, there was $150.0 million principal amount of the 9% notes outstanding.

PRICE RANGE OF OUR CLASS A COMMON STOCK AND DIVIDEND POLICY

Our Class A common stock is traded on the Nasdaq National Market under the symbol “SALM.” The following table sets forth for the fiscal quarters indicated the range of high and low intra-day bid information per share for our Class A common stock as reported on the Nasdaq National Market.

| High |

Low | |||||

| Fiscal Year Ended December 31, 2002 |

||||||

| First Quarter |

$ | 25.40 | $ | 21.80 | ||

| Second Quarter |

30.46 | 23.00 | ||||

| Third Quarter |

25.44 | 18.90 | ||||

| Fourth Quarter |

28.09 | 19.82 | ||||

| Fiscal Year Ended December 31, 2003 |

||||||

| First Quarter |

$ | 26.20 | $ | 15.00 | ||

| Second Quarter |

26.45 | 16.30 | ||||

| Third Quarter |

24.37 | 19.09 | ||||

| Fourth Quarter |

28.20 | 19.12 | ||||

| Fiscal Year Ending December 31, 2004 |

||||||

| First Quarter |

$ | 28.37 | $ | 23.08 | ||

| Second Quarter (through April 23, 2004) |

33.65 | 27.45 | ||||

As of April 23, 2004, there were approximately 30 stockholders of record of our Class A common stock and two stockholders of record of our Class B common stock. This number for our Class A common stock does not include an indeterminate number of beneficial owners of shares held of record by brokerage firms, clearing agencies or other nominees. On April 23, 2004, the last reported sale of the Class A common stock on the Nasdaq National Market was $33.08 per share.

Historically, we have not paid a dividend on either class of our common stock. We have historically retained earnings for use in our business and will continue to do so unless our board of directors makes a determination to declare and pay dividends on our common stock in light of and after consideration of our earnings, financial position, capital requirements, our bank credit facility, the indentures governing our senior subordinated notes and such other factors as the board of directors deems relevant. Our sole source of cash available for making dividend payments will be dividends paid to us or payments made to us by our subsidiaries. The ability of our subsidiaries to make such payments may be restricted by applicable state laws or terms of agreements to which they are or may become a party; Salem Holding’s credit facility and the terms of the indentures governing its outstanding senior subordinated notes restrict the payment of dividends on our common stock unless certain specified conditions are satisfied.

S-17

CAPITALIZATION

The following table sets forth our cash and cash equivalents position and capitalization at March 31, 2004, on an actual basis and a pro forma basis. The pro forma column reflects the issuance and sale of 2,325,000 shares of Class A common stock offered by us at an assumed public offering price per share of $33.08 (after deducting the underwriting discount and commissions and estimated offering expenses payable by us) and the assumed use of our net proceeds to redeem approximately $52.5 million principal amount of the outstanding 9% senior subordinated notes due 2011, with the remainder for general corporate purposes.

In addition, you should read the following table in conjunction with the sections of this prospectus supplement entitled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Selected Consolidated Financial and Other Data” and our consolidated financial statements and the notes thereto included in our Annual Report on Form 10-K for the year ended December 31, 2003.

| At March 31, 2004 | ||||||

| Actual |

Pro forma | |||||

| (In thousands) | ||||||

| Cash and cash equivalents |

$ | 4,159 | $ | 19,249 | ||

| Long-term debt, including current portion: |

||||||

| Revolving line of credit under credit facility |

$ | — | $ | — | ||

| Term loan under credit facility |

75,000 | 75,000 | ||||

| 9% senior subordinated notes due 2011 |

150,000 | 97,500 | ||||

| 7 ¾% senior subordinated notes due 2010 |

100,000 | 100,000 | ||||

| Fair market value of interest rate swap agreement |

6,806 | 6,806 | ||||

| Capital leases and other loans |

57 | 57 | ||||

| Total long-term debt, including current portion |

331,863 | $ | 279,363 | |||

| Stockholders’ equity: |

||||||

| Class A common stock, $0.01 par value; authorized 80,000,000 shares; issued and outstanding 17,984,217 shares, actual; 20,309,217 shares, pro forma(1) |

180 | 203 | ||||

| Class B common stock, $0.01 par value; authorized 20,000,000 shares; issued and outstanding 5,553,696 shares, actual and pro forma |

56 | 56 | ||||

| Additional paid-in capital(1) |

149,130 | 221,422 | ||||

| Retained earnings |

24,310 | 24,310 | ||||

| Total stockholders’ equity |

173,676 | 245,991 | ||||

| Total capitalization |

$ | 505,539 | $ | 525,354 | ||

| (1) | Excludes 758,416 shares of Class A common stock reserved for grants under our stock incentive plan at April 15, 2004. |

S-18

SELECTED CONSOLIDATED FINANCIAL AND OTHER DATA

The selected consolidated financial and other data presented below as of and for each of the five years in the period ended December 31, 2003, have been derived from our audited consolidated financial statements. The selected consolidated financial and other data set forth below should be read in conjunction with the section of this prospectus supplement entitled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and the notes thereto included in our Annual Report on Form 10-K for the year ended December 31, 2003. See our consolidated financial statements under Item 8 of our Annual Report on Form 10-K for the year ended December 31, 2003, which is incorporated by reference herein.

| Year Ended December 31, |

||||||||||||||||||||

| 1999 |

2000 |

2001 |

2002 |

2003 |

||||||||||||||||

| (In thousands) | ||||||||||||||||||||

| Statement of Operations Data: |

||||||||||||||||||||

| Net broadcasting revenue |

$ | 90,058 | $ | 113,010 | $ | 136,106 | $ | 156,216 | $ | 170,483 | ||||||||||

| Other media revenue |

6,424 | 7,916 | 8,016 | 8,054 | 7,865 | |||||||||||||||

| Total revenue: |

96,482 | 120,926 | 144,122 | 164,270 | 178,348 | |||||||||||||||

| Operating expenses: |

||||||||||||||||||||

| Broadcasting operating expenses |

49,227 | 63,187 | 87,772 | 103,809 | 109,043 | |||||||||||||||

| Costs of denied tower site and license upgrade |

— | — | — | — | 2,202 | |||||||||||||||

| Other media operating expenses |

9,985 | 14,863 | 9,282 | 7,709 | 7,942 | |||||||||||||||

| Legal settlement(1) |

— | — | — | 2,300 | — | |||||||||||||||

| Corporate expenses |

8,507 | 10,457 | 13,774 | 14,387 | 16,091 | |||||||||||||||

| Cost of terminated offering |

— | — | — | — | 651 | |||||||||||||||

| Stock and related cash grant |

2,550 | — | — | — | — | |||||||||||||||

| Depreciation and amortization |

18,233 | 25,065 | 30,026 | 11,446 | 12,291 | |||||||||||||||

| Total operating expenses |

88,502 | 113,572 | 140,854 | 139,651 | 148,220 | |||||||||||||||

| Operating income |

7,980 | 7,354 | 3,268 | 24,619 | 30,128 | |||||||||||||||

| Other income (expense): |

||||||||||||||||||||

| Interest income |

1,005 | 534 | 1,994 | 255 | 212 | |||||||||||||||

| Gain (loss) on disposal of assets |

(219 | ) | 773 | 26,276 | (567 | ) | (214 | ) | ||||||||||||

| Gain on sale of assets to related parties |

— | 28,794 | 3,560 | — | — | |||||||||||||||

| Interest expense |

(14,219 | ) | (17,452 | ) | (26,542 | ) | (27,162 | ) | (23,474 | ) | ||||||||||

| Loss on early retirement of debt |

(5,556 | ) | (1,849 | ) | — | — | (6,440 | ) | ||||||||||||

| Other expense |

(633 | ) | (857 | ) | (573 | ) | (458 | ) | (410 | ) | ||||||||||

| Total other income (expense) |

(19,622 | ) | 9,943 | 4,715 | (27,932 | ) | (30,326 | ) | ||||||||||||

| Income (loss) before income taxes and discontinued operations |

(11,642 | ) | 17,297 | 7,983 | (3,313 | ) | (198 | ) | ||||||||||||

| Provision (benefit) for income taxes |

(3,597 | ) | 6,675 | 2,442 | (1,323 | ) | 479 | |||||||||||||

| Income (loss) before discontinued operations |

(8,045 | ) | 10,622 | 5,541 | (1,990 | ) | (677 | ) | ||||||||||||

| Income (loss) from discontinued operations, net of tax |

— | (513 | ) | (1,154 | ) | 15,995 | — | |||||||||||||

| Net income (loss) |

$ | (8,045 | ) | $ | 10,109 | $ | 4,387 | $ | 14,005 | $ | (677 | ) | ||||||||

S-19

| Year Ended December 31, |

||||||||||||||||||||

| 1999 |

2000 |

2001 |

2002 |

2003 |

||||||||||||||||

| (In thousands, except share and per share data) | ||||||||||||||||||||

| Basic Earnings (Loss) Per Share Data: |

||||||||||||||||||||

| Earnings (loss) per share before discontinued operations |

$ | (0.40 | ) | $ | 0.45 | $ | 0.24 | $ | (0.08 | ) | $ | (0.03 | ) | |||||||

| Income (loss) from discontinued operations |

— | (0.02 | ) | (0.05 | ) | 0.68 | — | |||||||||||||

| Earnings (loss) per share(2) |

(0.40 | ) | 0.43 | 0.19 | 0.60 | (0.03 | ) | |||||||||||||

| Diluted Earnings (Loss) Per Share Data: |

||||||||||||||||||||

| Earnings (loss) per share before discontinued operations |

$ | (0.40 | ) | $ | 0.45 | $ | 0.24 | $ | (0.08 | ) | $ | (0.03 | ) | |||||||

| Income (loss) from discontinued operations |

— | (0.02 | ) | (0.05 | ) | 0.68 | — | |||||||||||||

| Earnings (loss) per share(2) |

(0.40 | ) | 0.43 | 0.19 | 0.59 | (0.03 | ) | |||||||||||||

| Basic weighted average shares outstanding |

20,066,006 | 23,456,088 | 23,456,828 | 23,473,821 | 23,488,898 | |||||||||||||||

| Diluted weighted average shares outstanding |

20,066,006 | 23,466,849 | 23,518,747 | 23,582,906 | 23,488,898 | |||||||||||||||

| Balance Sheet Data (at end of period): |

||||||||||||||||||||

| Cash and cash equivalents |

$ | 34,124 | $ | 3,928 | $ | 23,921 | $ | 26,325 | $ | 5,620 | ||||||||||

| Restricted cash |

— | — | — | 107,661 | — | |||||||||||||||

| Broadcast licenses |

131,635 | 340,201 | 323,848 | 363,203 | 381,740 | |||||||||||||||

| Other intangible assets including goodwill, net |

18,885 | 18,281 | 20,211 | 17,305 | 15,391 | |||||||||||||||

| Total assets |

264,364 | 470,668 | 507,254 | 672,209 | 560,011 | |||||||||||||||

| Long-term debt, including current portion |

103,335 | 286,143 | 312,286 | 450,937 | 336,106 | |||||||||||||||

| Total stockholders’ equity |

$ | 142,839 | $ | 152,948 | $ | 157,370 | $ | 171,928 | $ | 171,822 | ||||||||||

| Cash Flows Related To: |

||||||||||||||||||||

| Operating activities |

8,204 | 10,712 | 11,633 | 6,814 | 24,034 | |||||||||||||||